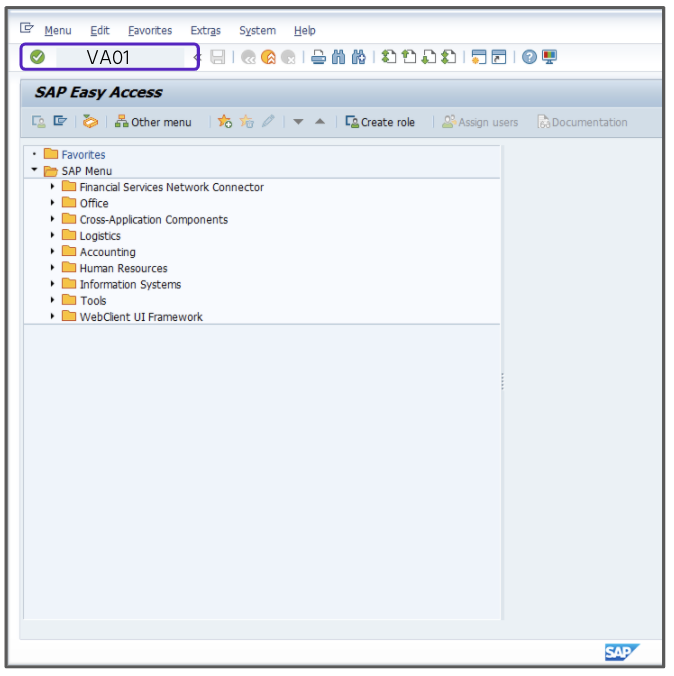

- Enter the T-Code /nVA01.

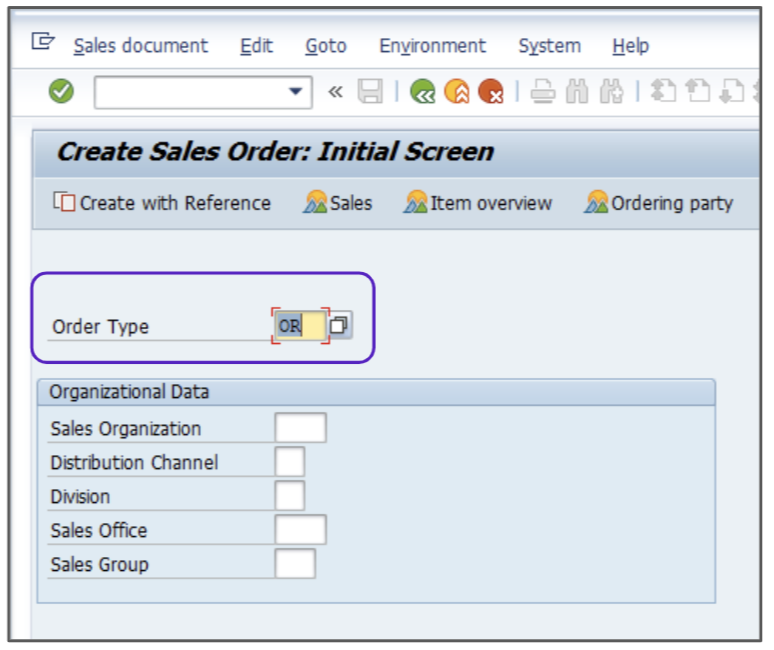

- In the Order Type field, enter OR.

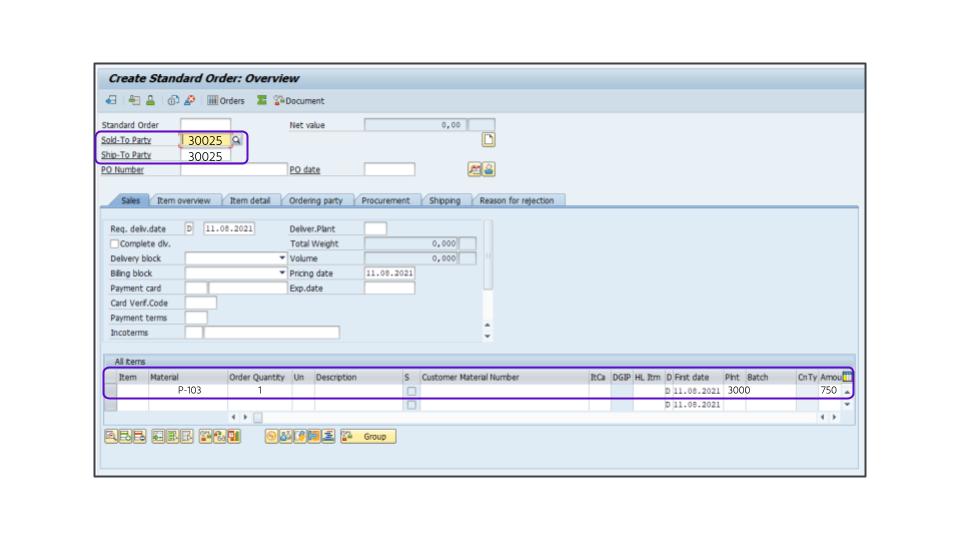

- Enter the appropriate value in the Sold-To Party field, for example, 30025.

- Enter the appropriate value in the Ship-To Party field, for example, 30025.

- In the Material field, enter P-103.

- Enter the appropriate value in the Target Quantity field, for example, 1.

- Enter the appropriate value in the Plnt field, for example, 3000.

- Enter the appropriate value in the Amount field, for example, 750.

- Click Enter.

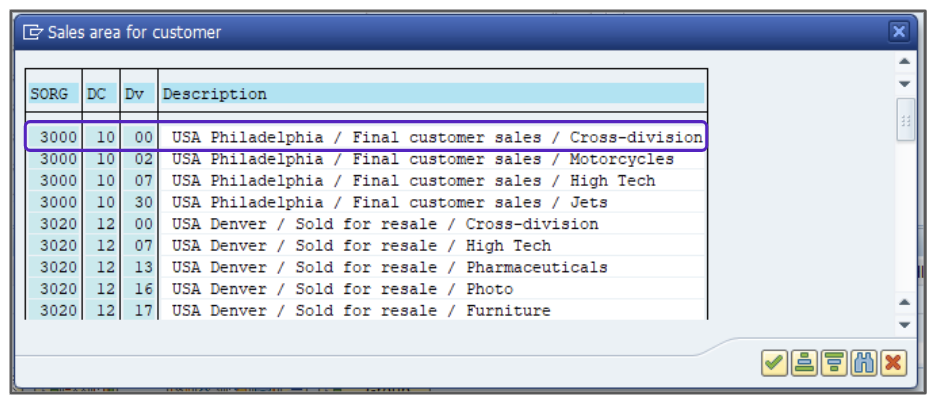

- Double click the first line item to choose a Sales Organization/Distribution Channel/Division combination for the record.

- Accept all the default recommendations in the order.

- With the form selected, go to GoTo > Header > Conditions.

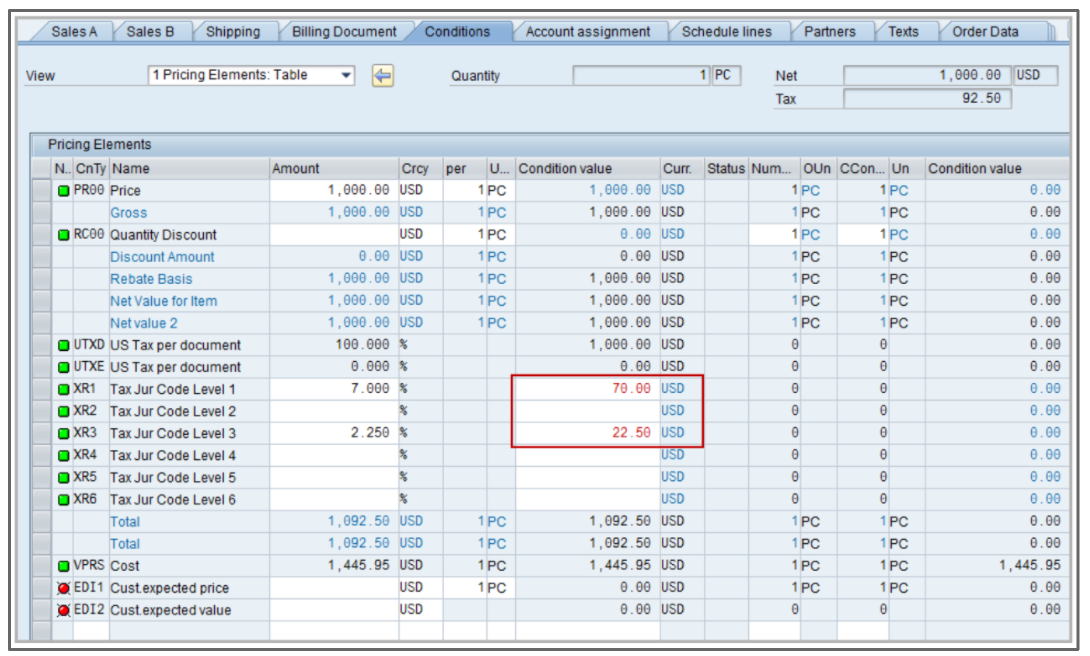

- Review the line item conditions.

- Press F3.

- Select the item line.

- Click the

button.

button.

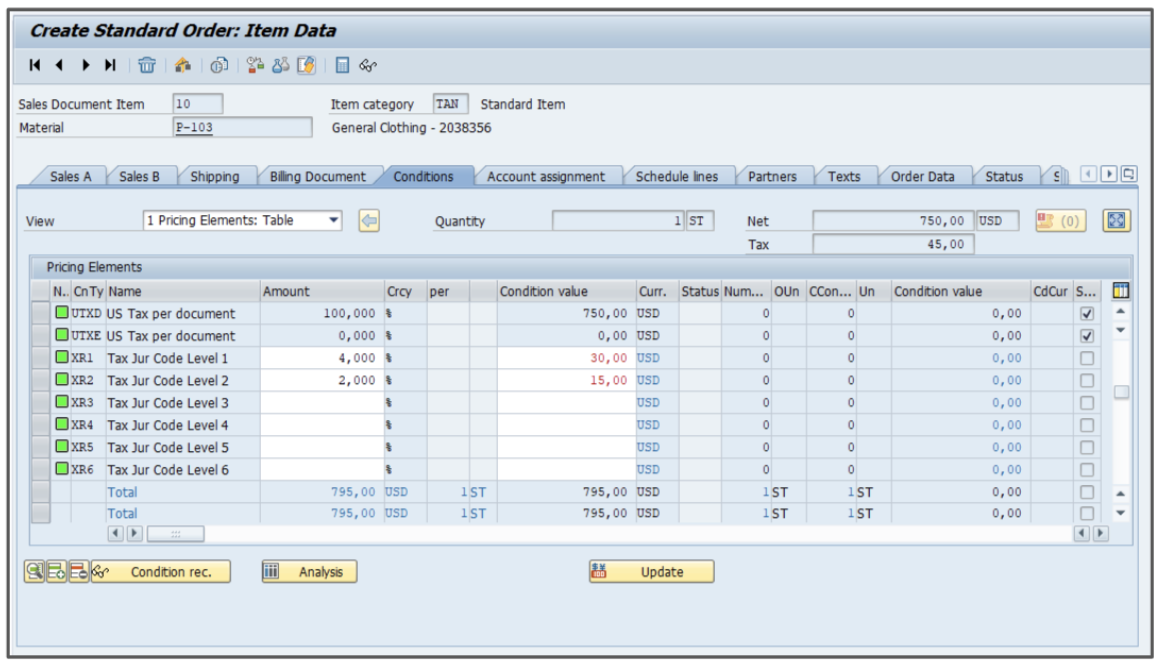

- Override the condition value column of the XR1 row by reducing the dollar amount by the appropriate value, for example, $10.

- With the form selected, go to GoTo > Header > Conditions.

- Verify that your adjustment was not overwritten.

- Review the line item conditions:

- Press F3.

- Select the item line.

- Click the

button.

button.

- Click Save, then document the order number for your records.

Attention!

The Sales and Use Tax Help Center has moved to Sovos Docs. This Help Center will be shutting down soon and you will be able to access documentation on Sovos Docs only.