If some of your customers have tax exemptions, you will need to add those to the customer after you have created that customer in Global Tax Determination. Once that’s done, a few extra steps are still necessary when creating a standard sales order.

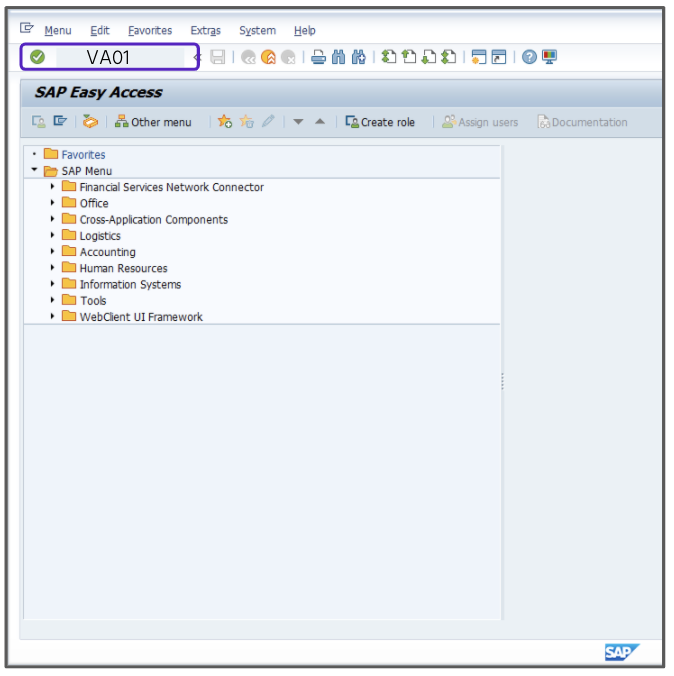

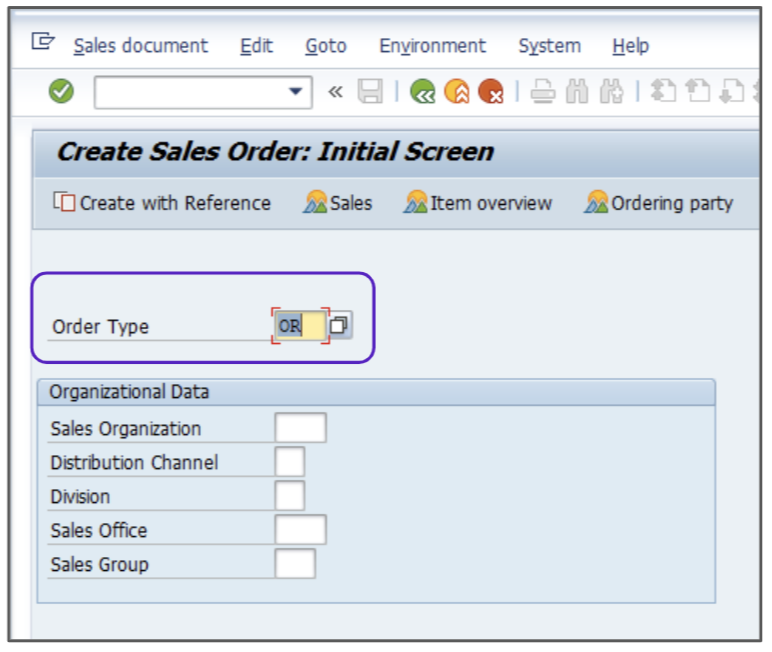

- Enter the T-Code VA01.

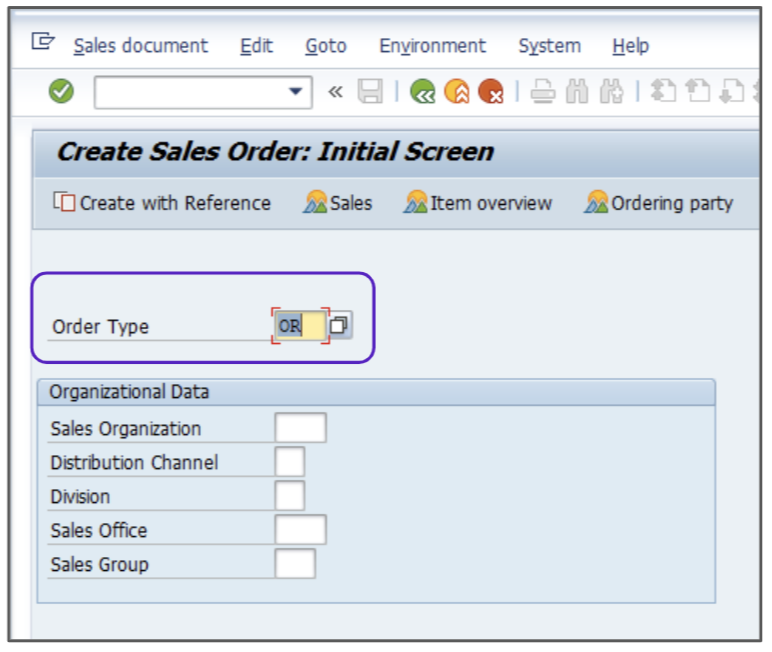

- In the Order Type field, enter OR.

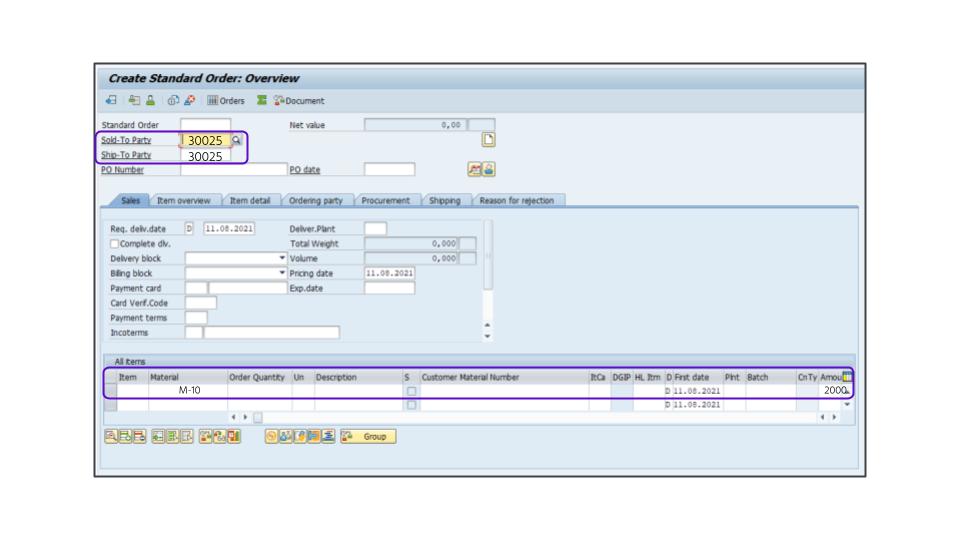

- Click Enter, then the Create Standard Order: Overview screen will appear.

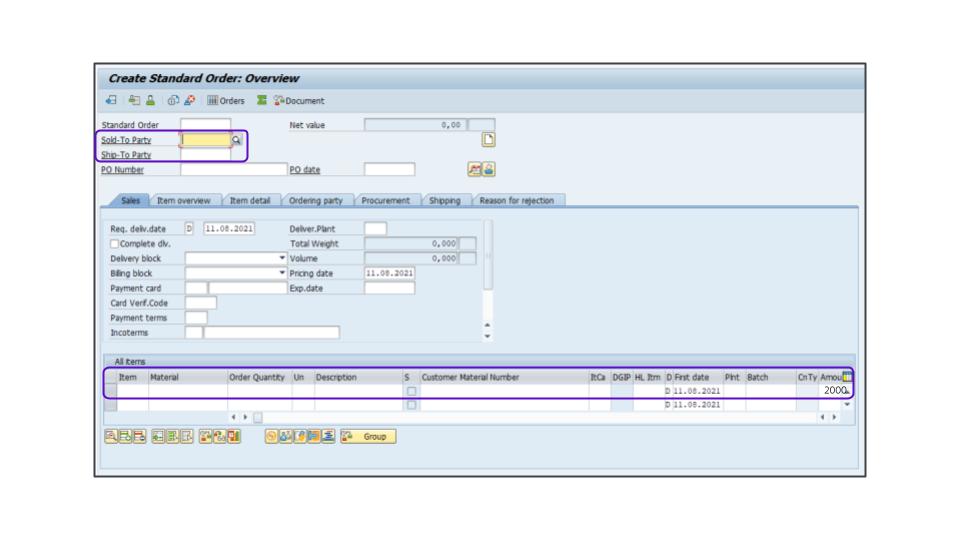

- In the Sold-To Party field, enter a location for a customer that has been configured in Global Tax Determination.

- In the Ship-To Party field, enter a location for a customer that has been configured in Global Tax Determination.

-

Follow the remaining steps in How to create a standard sales order.

Creating a sales order for exempt products and services

Products and services can be partially or fully exempt based on the tax laws in certain taxing jurisdictions. The tax law content in Global Tax Determination can determine how items and services are taxed based on these laws and the location. However, the product or service in SAP must be mapped to a Goods/Service code in Global Tax Determination.

For a list of available Goods/Service codes, check out the Goods/Service Code Guide included in your Global Tax Determination quarterly content update.

Consult your tax professional to decide which Goods/Service Codes should be used for specific items or services.

- Enter the T-Code VA01.

- In the Order Type field, enter OR.

- Click Enter, then the Create Standard Order: Overview screen will appear.

- Enter the appropriate value in the Sold-To Party field, for example, 300025.

- Enter the appropriate value in the Ship-To Party field, for example, 300025.

- In the Material field, enter M-10.

The item used here should be mapped in Global Tax Determination to a Goods/Service Code.

- Follow the remaining steps in How to create a standard sales order.