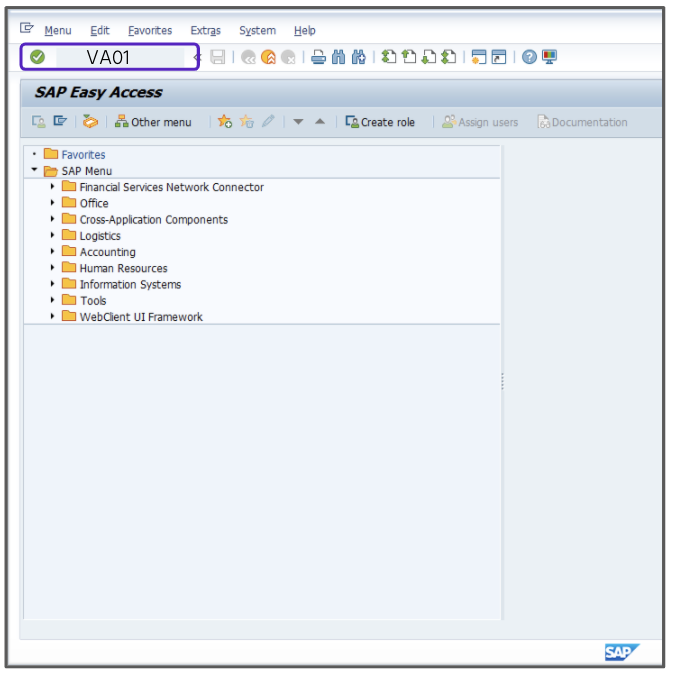

- Enter the T-Code /nVA01.

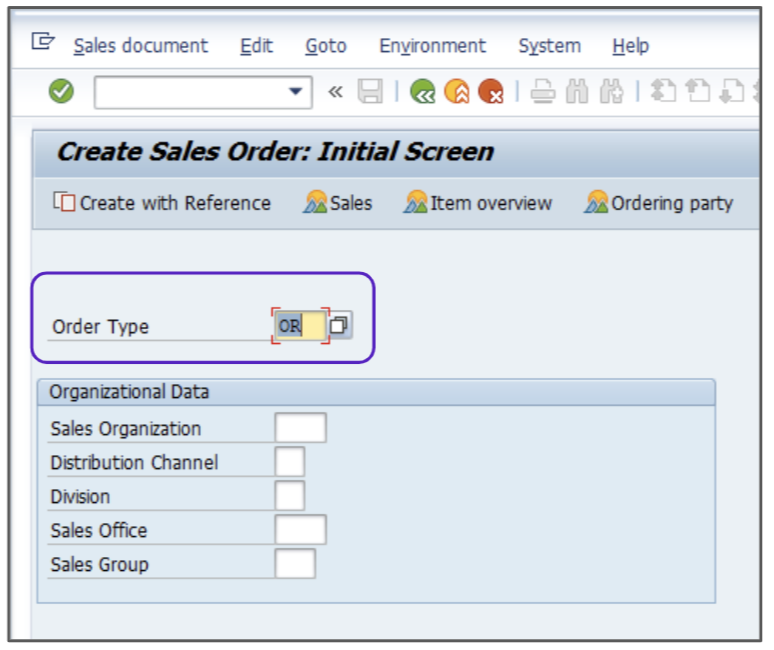

- In the Order Type field, enter OR.

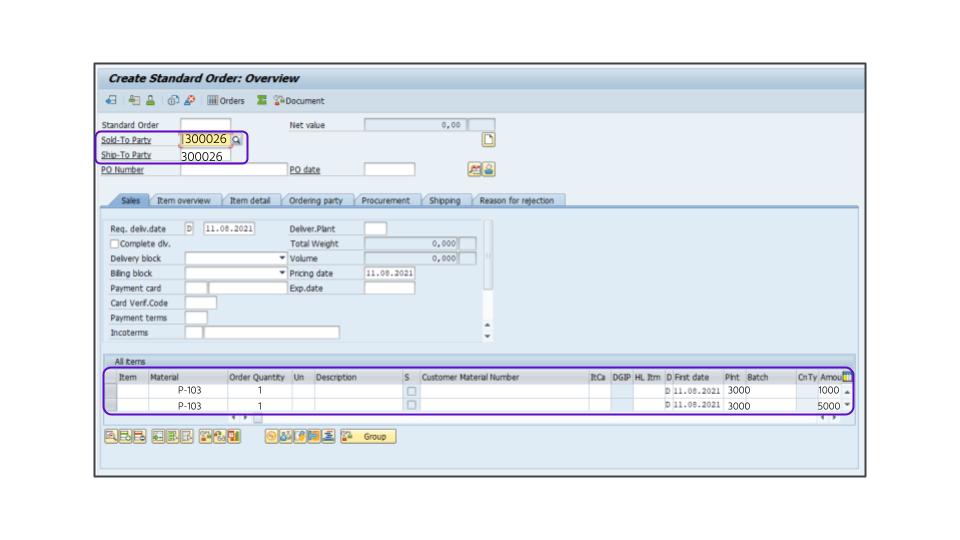

- Enter the appropriate value in the Sold-To Party field, for example, 300026.

- Enter the appropriate value in the Ship-To Party field, for example, 300026.

- Create the following three line items:

-

- Enter P-103 in the material field, and the appropriate values in the quantity, plant, and amount fields, for example, 1, 3000, and 1000.

- Enter P-103 in the material field, and the appropriate values in the quantity, plant, and amount fields, for example, 1, 3000, and 5000.

- Enter P-103 in the material field, and the appropriate values in the quantity, plant, and amount fields, for example, 3, 3000, and 1000.

-

- Click Enter.

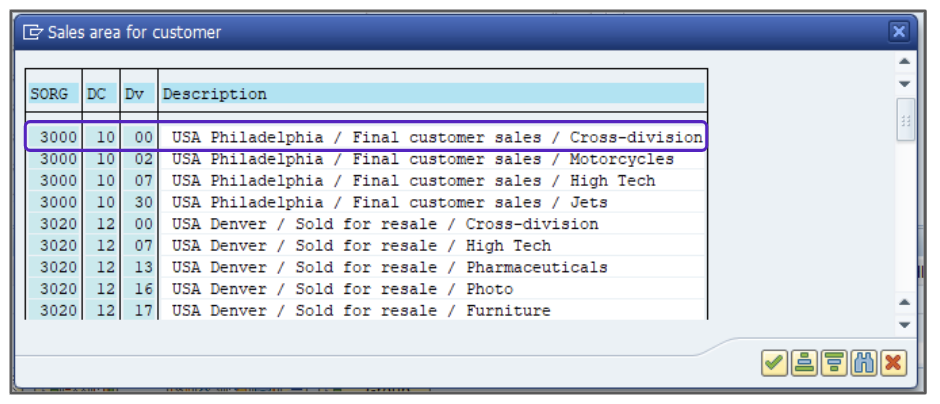

- Double click the first line item to choose a Sales Organization/Distribution Channel/Division combination for the record.

- Select the correct form, then navigate to GoTo > Header > Conditions.

- Review the first line item conditions.

- Press F3.

- Select the first item line.

- Click the

icon to see the Pricing Conditions.

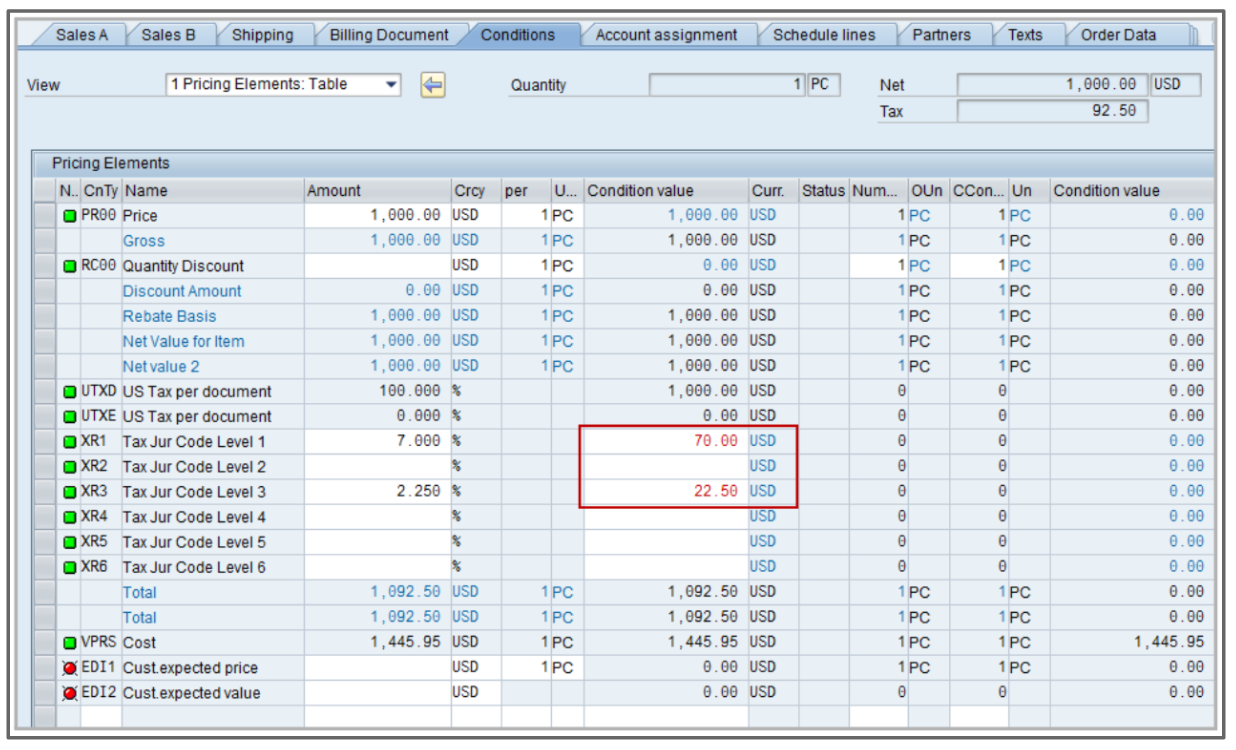

icon to see the Pricing Conditions. - The entire amount for the $1000 single item is subject to tax at the XR1 and XR3 levels. This should be shown:

- Review the second line item conditions.

- Press F3.

- Select the second item line.

- Click the

icon to see the Pricing Conditions.

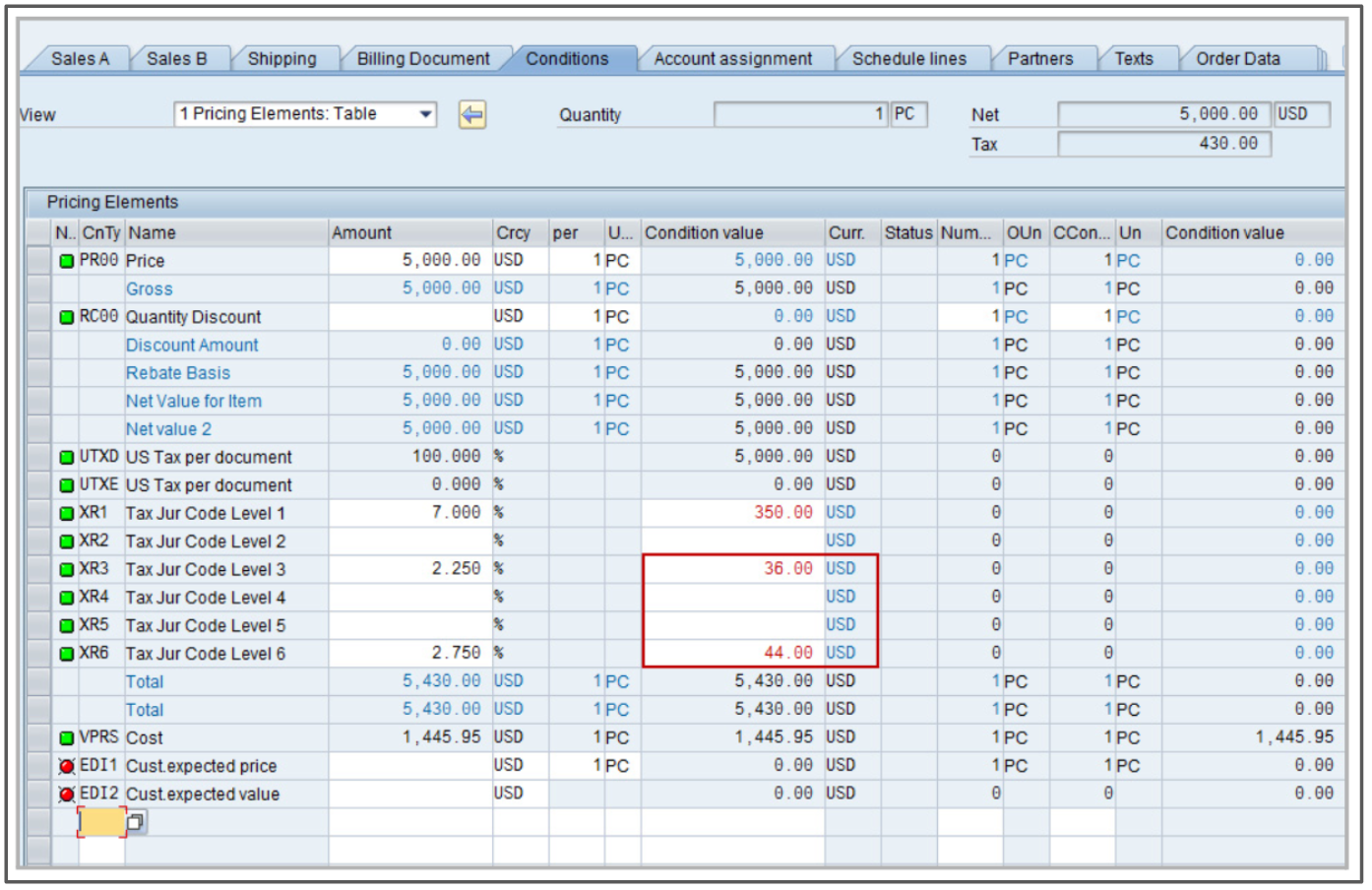

icon to see the Pricing Conditions. - The XR3 level amount is capped at $1600 and the remaining amount between $1600 and $3200 will be assessed on the XR6 line. This should be shown:

- Click Save, then document the order number for your records.

Attention!

The Sales and Use Tax Help Center has moved to Sovos Docs. This Help Center will be shutting down soon and you will be able to access documentation on Sovos Docs only.