This purchase order includes a line item with a supplier-charged tax and a line item where the tax is self-assessed. The line items designated as U1 will get audited, those designated as I1, won't.

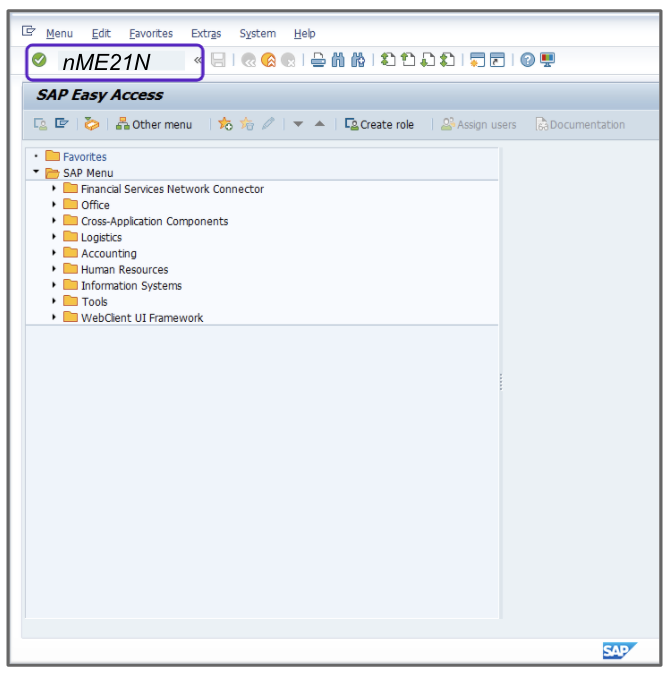

- Enter the T-Code /nME21N to create a Purchase Order.

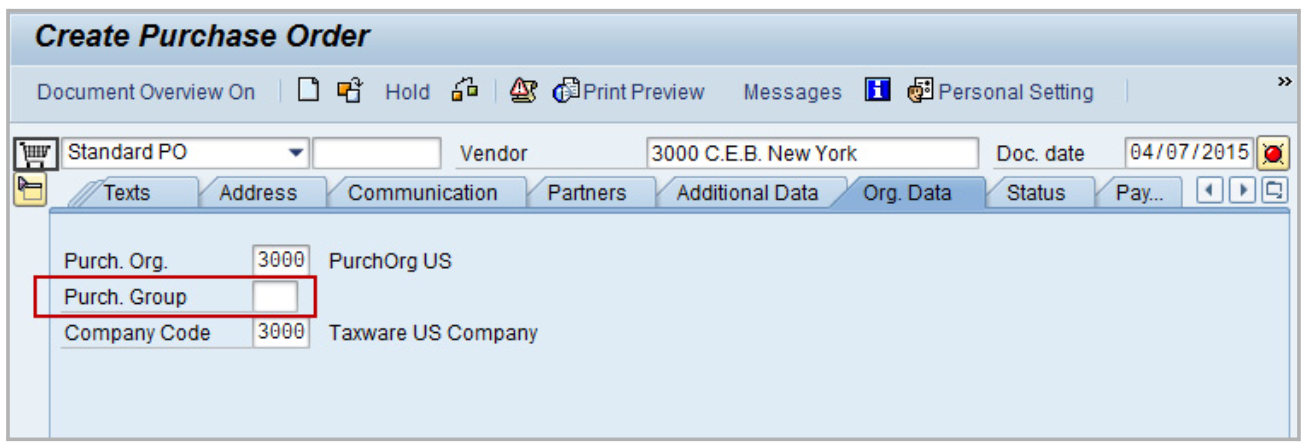

- Enter the appropriate value in the Vendor field, for example, 3000.

- Enter the appropriate value in the Purch. Org. field, for example, 3000.

- Enter the appropriate value in the Company Code field, for example, 3000.

- Click Enter.

- Enter 001 in the Purch. Group field.

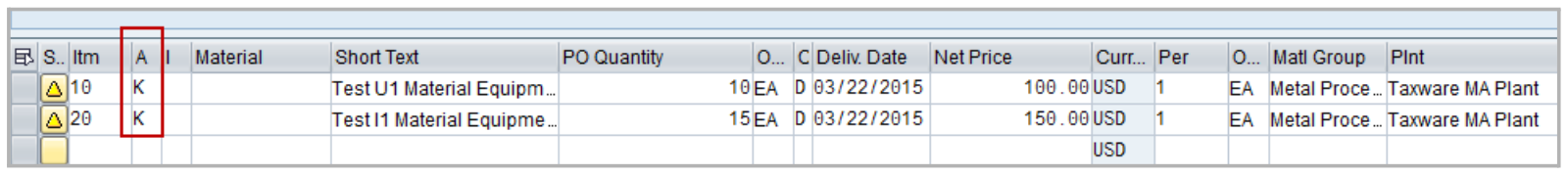

- Fill out all following fields with the appropriate values. Make sure that you enter K in the A (Acct Ass. Cat.) column, the other values in the fields are just examples.

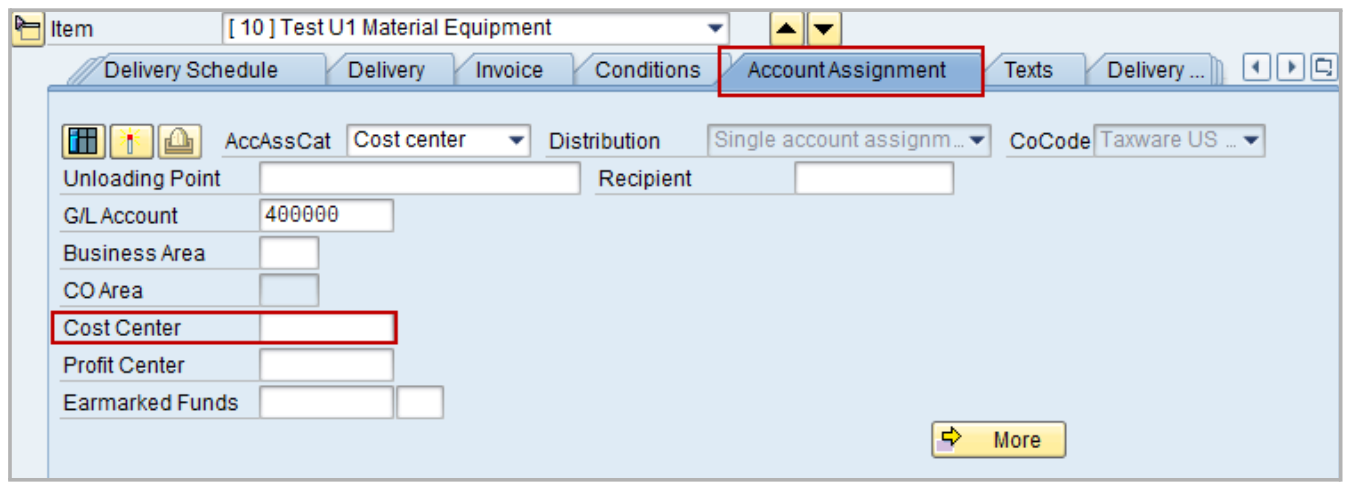

- Click

to display the item details.

to display the item details. - Go to Account Assignment and enter a Cost Center.

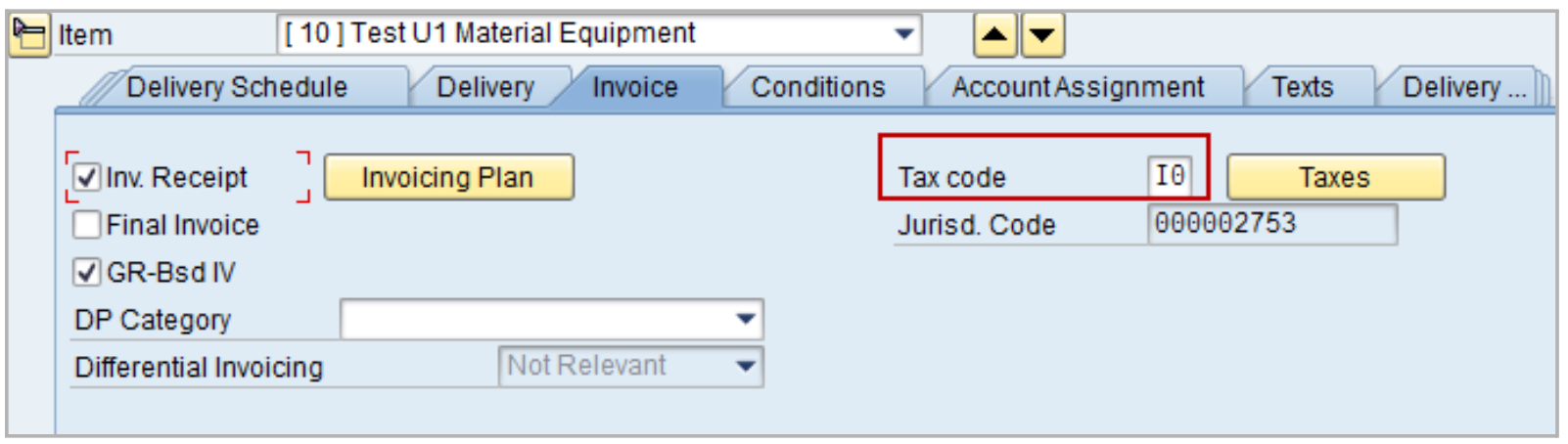

- For the first line item, go to the Invoice tab, and set the Tax Code field to U1.

- For the second line item, go to the Invoice tab, and set the Tax Code field to I1.

- For each line item, click Taxes.

- Click Save.

- Take note of the order number for your records.