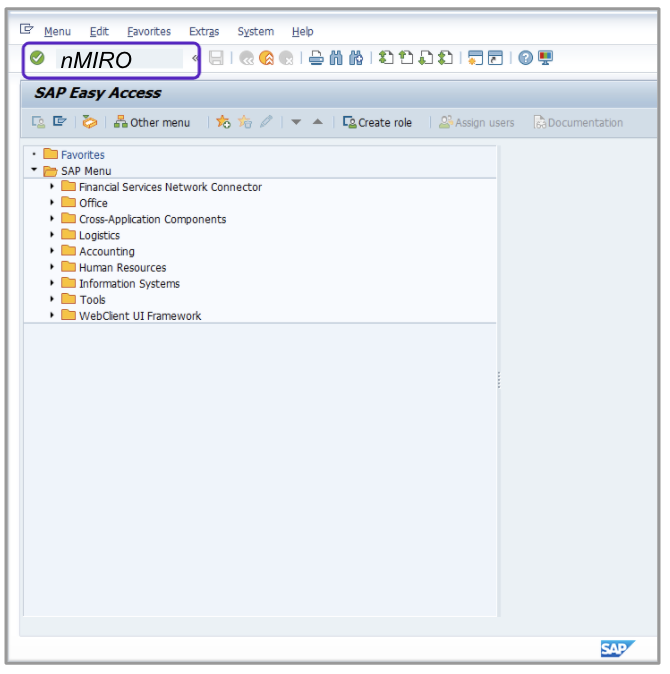

- Enter the T-Code /nMIRO to create a vendor invoice.

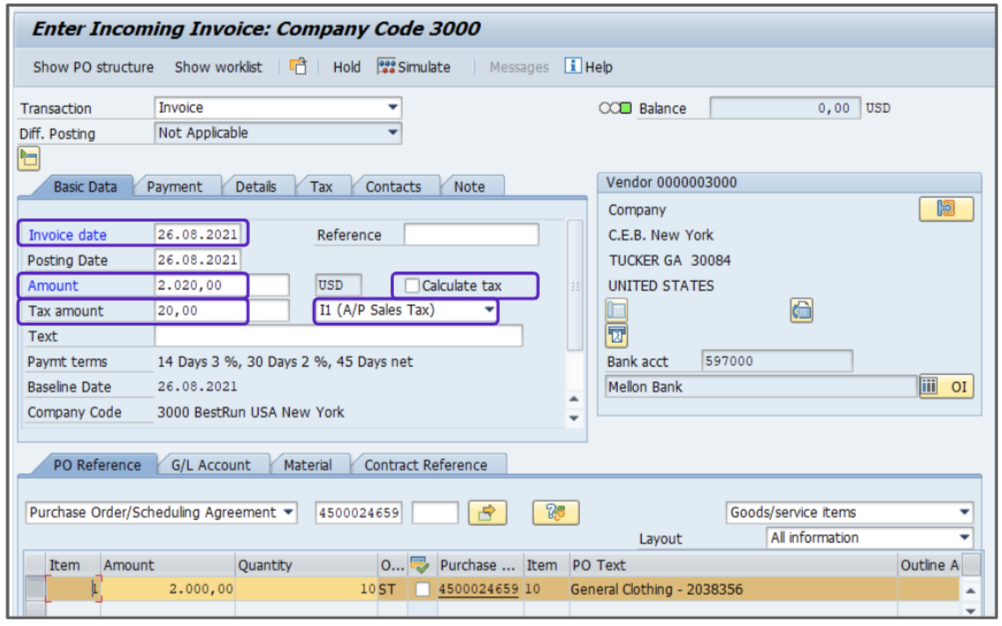

- Enter the current date in the Invoice Date field.

- Change the Tax Type field to I1.

- Enter an existing purchase order number.

- Verify that the Calculate Tax check box is NOT selected.

- Enter the total amount to be invoiced including the supplier-charged tax in the Amount field.

- Enter the supplier-charged tax in the Tax Amount field.

- Click Enter.

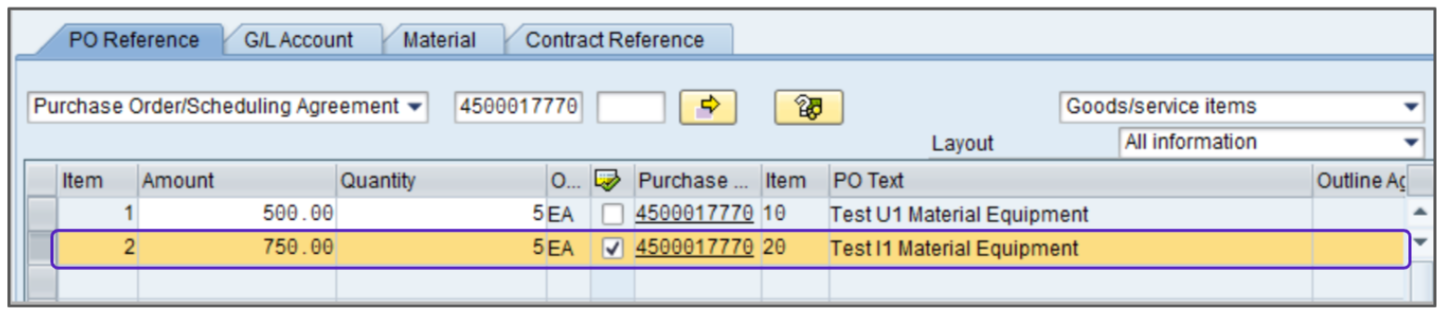

- Select the line item with the vendor-supplied tax.

- Click Simulate.

- Your transaction is now in balance and can be posted because the supplier charged tax matches the tax amount calculated.

Attention!

The Sales and Use Tax Help Center has moved to Sovos Docs. This Help Center will be shutting down soon and you will be able to access documentation on Sovos Docs only.