To create an AR memo, make a sales invoice without a sales order or delivery first. See How to create a sales invoice without a sales order or delivery for instructions.

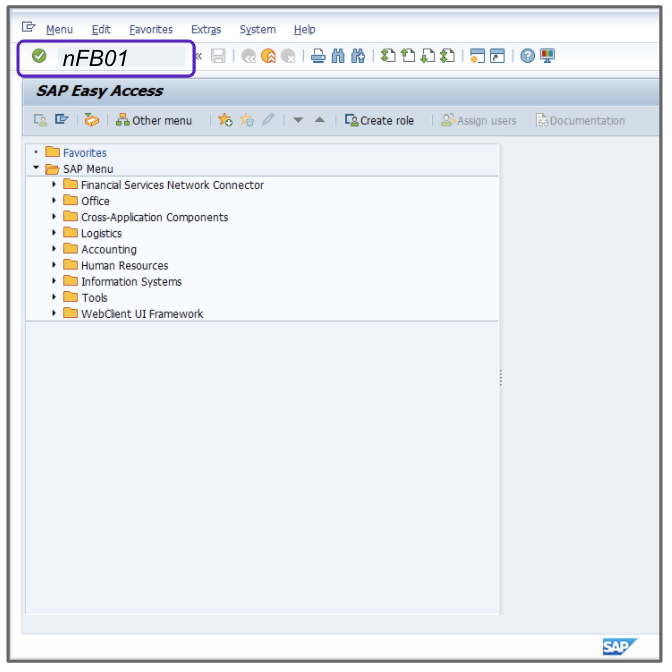

- Enter the T-Code /nFB01 to create an invoice.

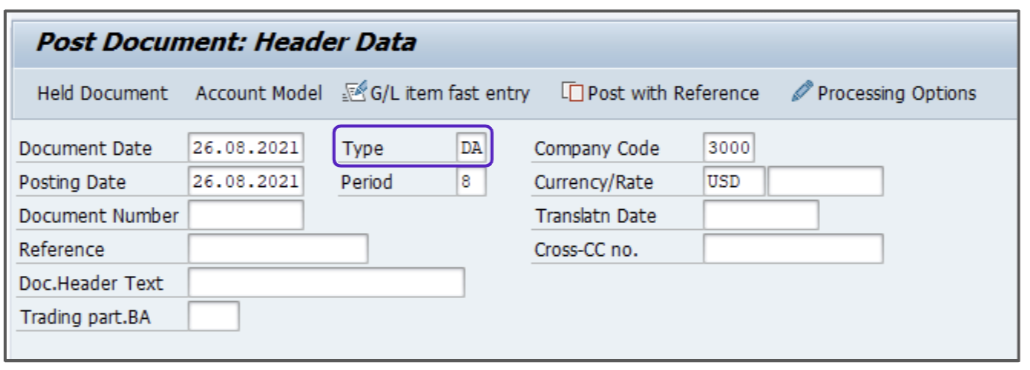

- Enter the current date in the Document Date.

- Enter DA in the Type field.

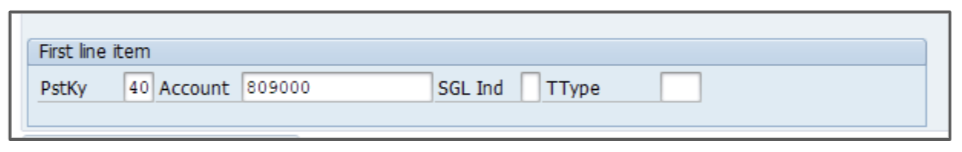

- In the First Line Item section, do the following:

-

- Enter the appropriate value, for example, 40 in the PKey field.

- Enter the appropriate value, for example, 809000 in the Account field.

This field should match the G/L Account field of the previously created sales invoice without a sales order or delivery.

-

- Press Enter. Ignore any warnings.

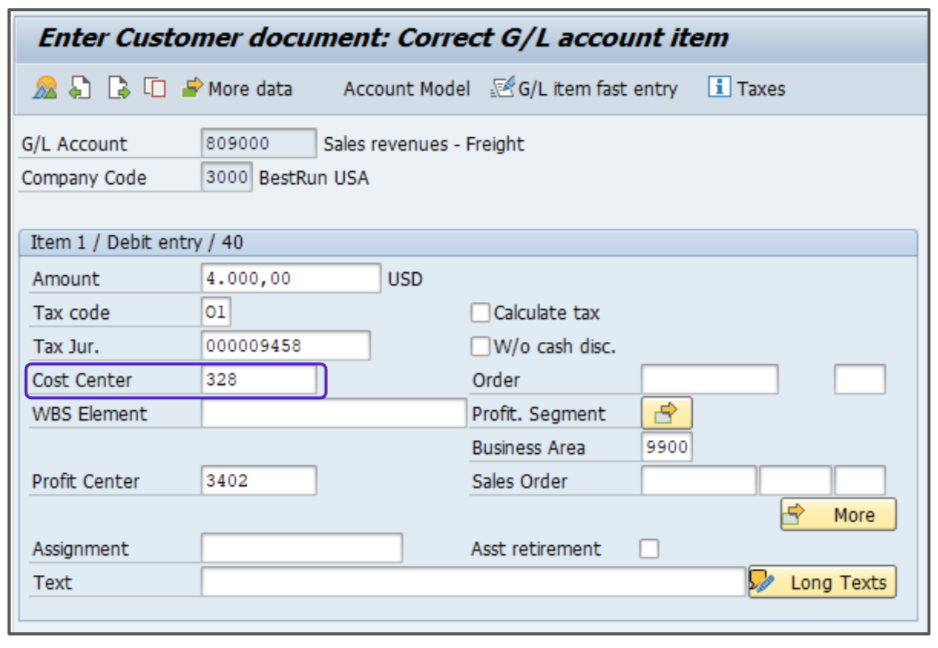

- In the Amount field enter the amount in the sales invoice without a sales order/delivery.

- Select O1 Tax from the tax code dropdown menu.

- Enter the Tax Jurisdiction Code from the sales invoice without a sales order or delivery.

- Enter the appropriate value, for example, 328 in the Cost Center column.

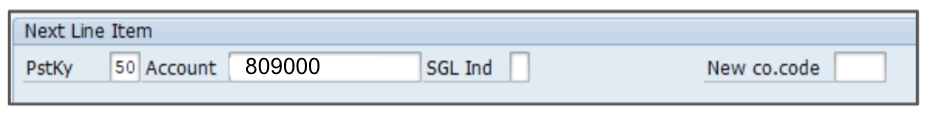

- In the Next Line Item section below, do the following:

-

- Enter the appropriate value, for example, 50 in the PKey field.

- Enter the appropriate value, for example, 809000 in the Account field.

This field should match the G/L Account field of the previously created sales invoice without a sales order or delivery.

-

- Press Enter. Ignore any warnings.

- Fill in the Amount field with the amount in the sales invoice without a sales order/delivery.

- Select O0 Tax from the tax type dropdown menu.

- Enter the Tax Jurisdiction Code from the same use case.

- Enter 328 in the Cost Center column.

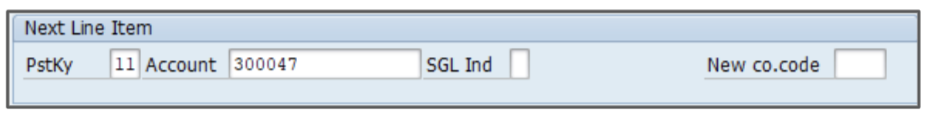

- In the Next Line Item section, do the following:

- Enter the appropriate value, for example, 11 in the PKey field.

- Enter the appropriate value, for example,300047 in the Account field.

This field should match the G/L Account field of the previously created sales invoice without a sales order or delivery.

- Press Enter. Ignore any warnings.

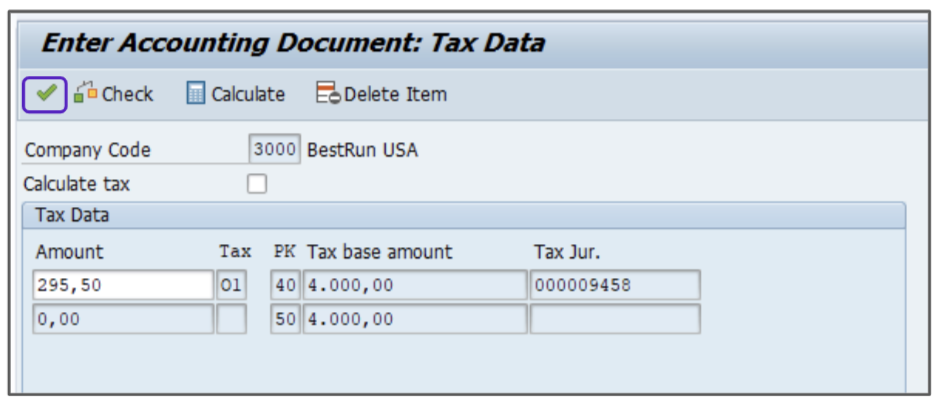

- Enter the tax amount to be credited in the Amount field.

- Click the

icon, then on the new screen, click

icon, then on the new screen, click  to verify the tax amount.

to verify the tax amount.

- Enter the tax amount credited back to the customer as shown in the How to create a sales invoice without a sales order or delivery article.

- Verify that the Calculate Tax check box is NOT selected.

- Click

to continue.

to continue.

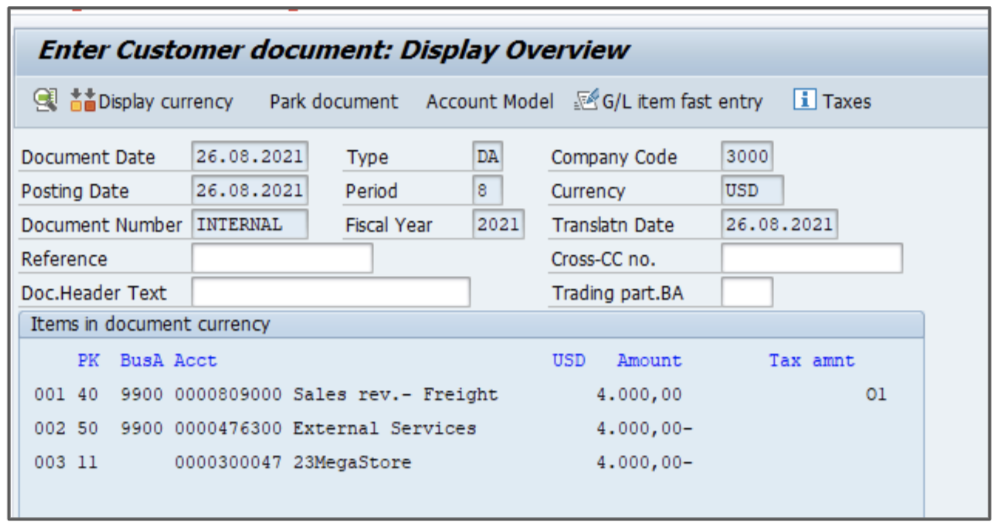

- From the main menu, go to Document > Simulate General Ledger.

- Click Save to post the Invoice.

- A new document number will be displayed at the bottom of your screen. Save this document number for your records.