This recipe shows how to override the original values of an invoice in case the taxes charged by the supplier are different from what was recorded on the invoice.

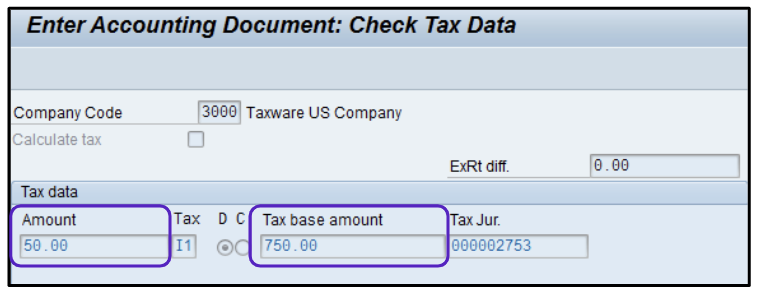

- Let’s assume that your invoice has a 46.88 Tax amount on an Amount of 796.88 but the tax the supplier actually charged is 50.00. Modify the Amount to reflect this, and change the Tax base amount to 750.00 to balance out the difference.

- You will be warned that the tax entered is incorrect. Press Enter.

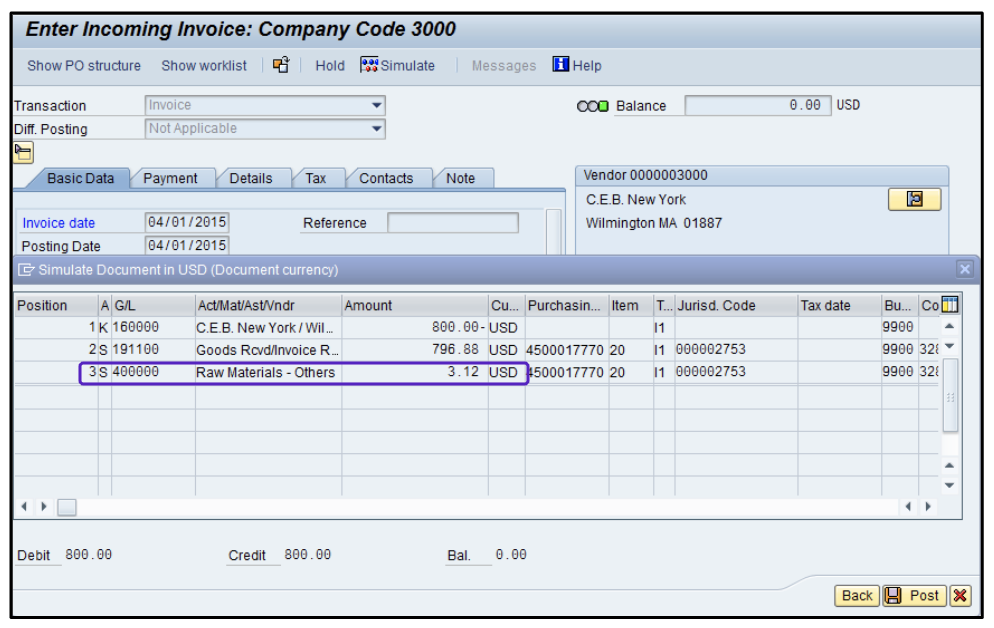

- Review the balance screen. The excess tax is now assigned to a separate G/L Account.

- Click Post.

- You will be warned that the tax entered is incorrect. Press Enter.

- Take note of the document number for your records and review the audited transaction.