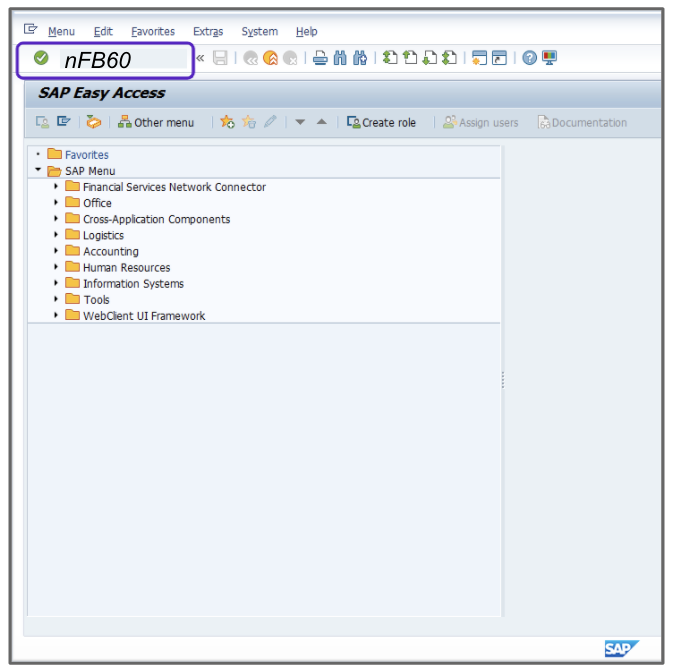

- Enter the T-Code /nFB60 to create an invoice.

- Enter the appropriate value, for example, 3000 in the Company Code field.

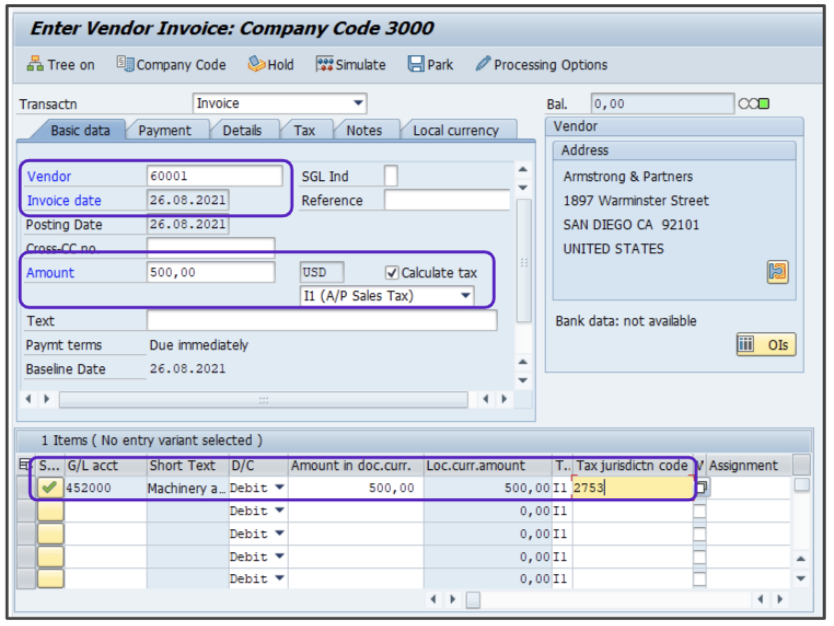

- Enter the appropriate value, for example, 60001 in the Vendor number field.

- Enter the current date as the invoice date.

- Enter the appropriate value, for example, 500 in the Amount field.

- Select I1-A/P Sales Tax from the tax type dropdown menu.

- Select the Calculate tax box.

- At the line item level, enter the appropriate value, for example, 452000 in the G/L acct column.

- Double click in the short text field, then press Enter to bypass any warnings.

- Enter the appropriate value, for example, 500 in the Amount in doc. curr. column.

- Override the Tax jurisdiction code with the appropriate value, for example, 2753.

- Scroll to the right and enter the appropriate value, for example, 328 in the Cost Center column.

- You will be warned that the Account assignment object has jurisdiction code, then press Enter.

- Click Simulate, ignore any warnings.

- Click the

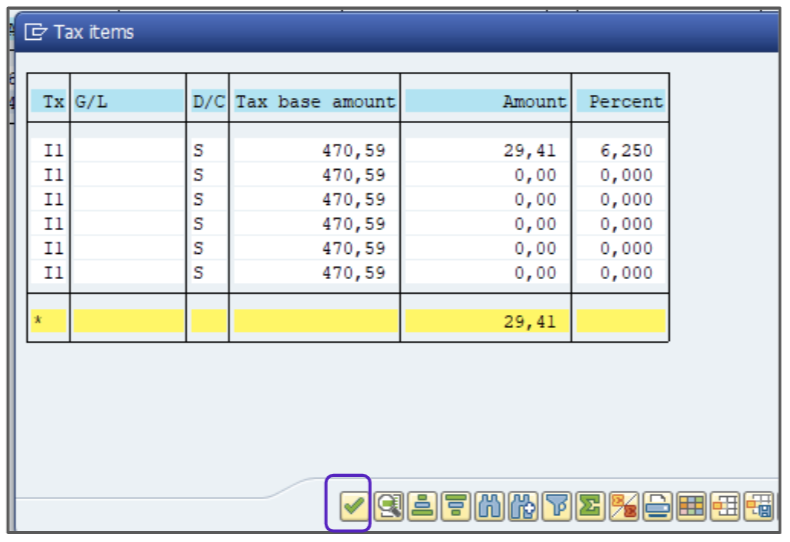

icon to verify the tax amount, then the Tax items popup will appear on the screen.

icon to verify the tax amount, then the Tax items popup will appear on the screen. - Click the

icon to close the Tax items window.

icon to close the Tax items window.

- Click Save to post the invoice. A new document number will be displayed at the bottom of your screen.

- Take note of the document number for your records.

Attention!

The Sales and Use Tax Help Center has moved to Sovos Docs. This Help Center will be shutting down soon and you will be able to access documentation on Sovos Docs only.