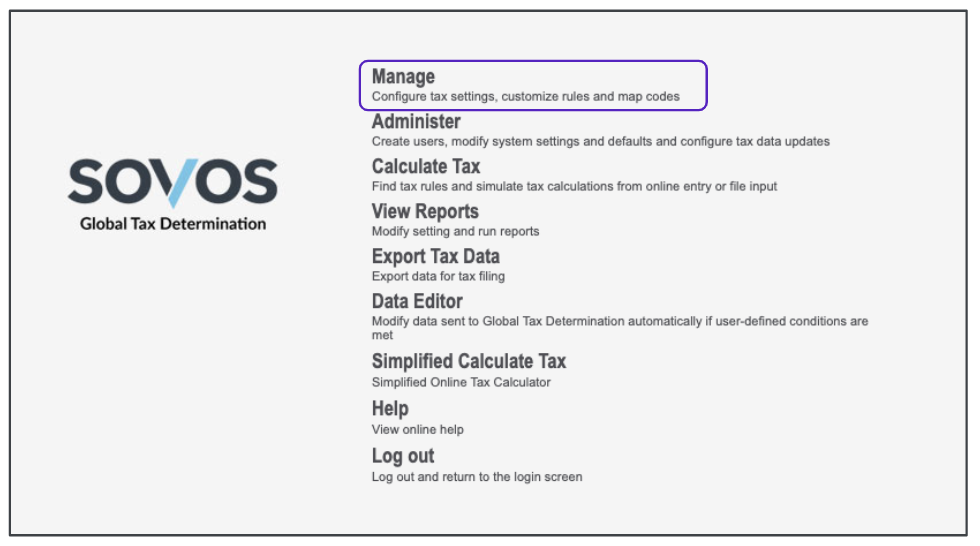

- Log in to Global Tax Determination.

- Click Manage.

- Select your organization by following the steps in this article.

-

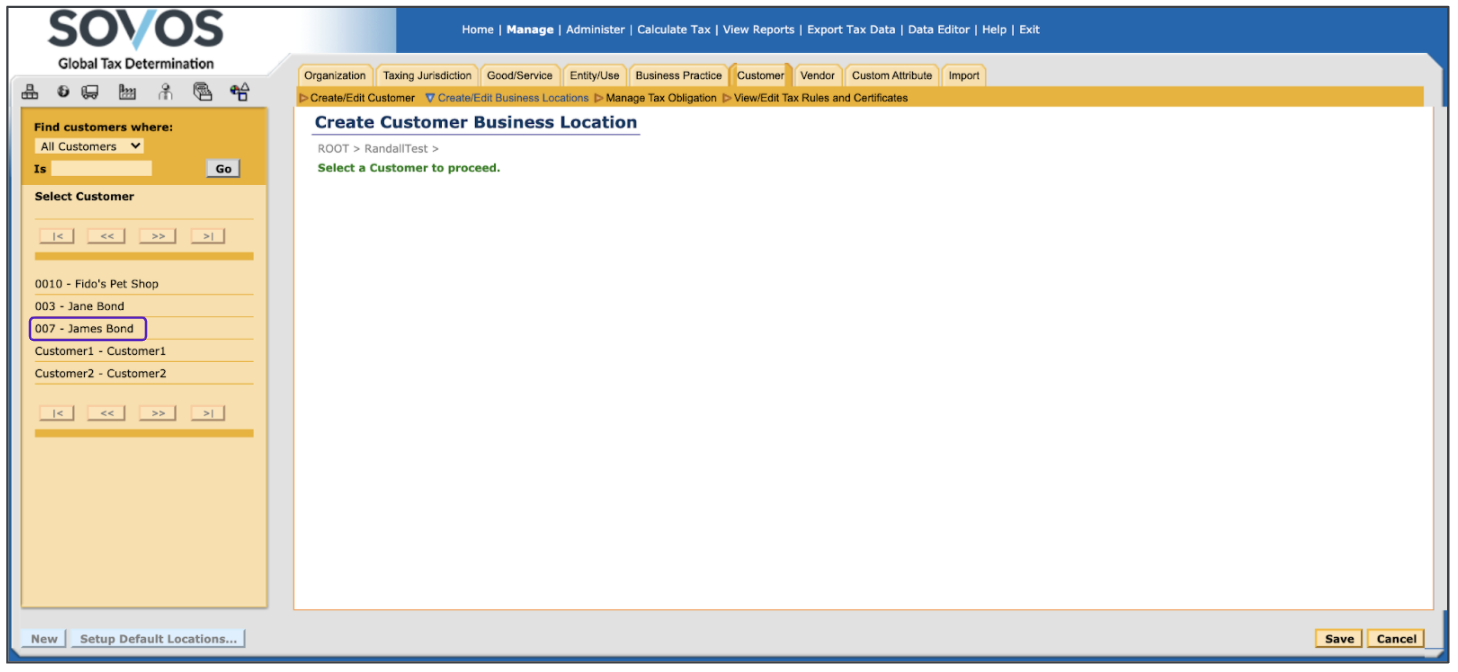

Click the Customer tab and select the Create/Edit Business Locations task.

-

Select your customer from the left panel.

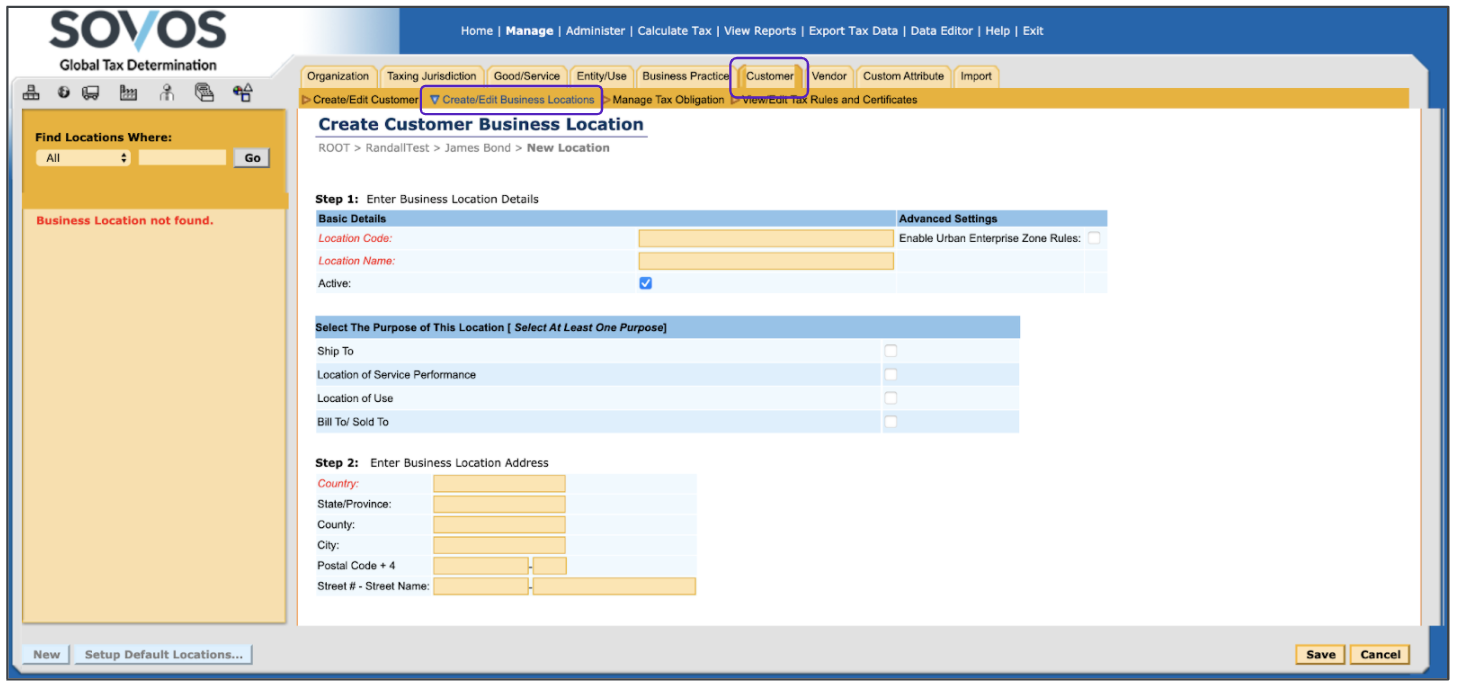

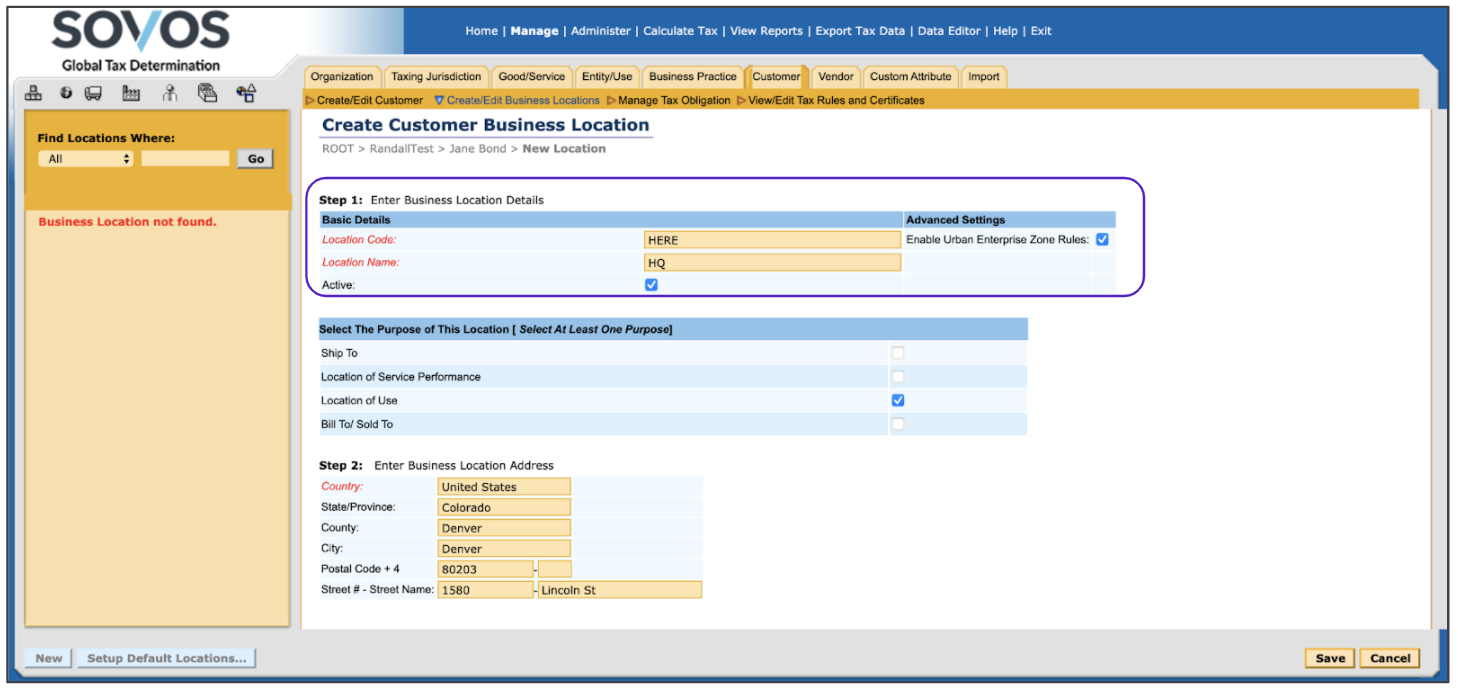

- In Step 1, enter the customer’s location code in the Location Code and their location name in the Location Name field. The location code identifies the customer’s location in Global Tax Determination and it must be the same as the location code used in your ERP. The Location name is also used to identify the customer’s business location in Global Tax Determination.

Don’t use any spaces in location codes.

-

The Active checkbox is automatically selected for valid addresses. If this business location is no longer valid, clear this box.

-

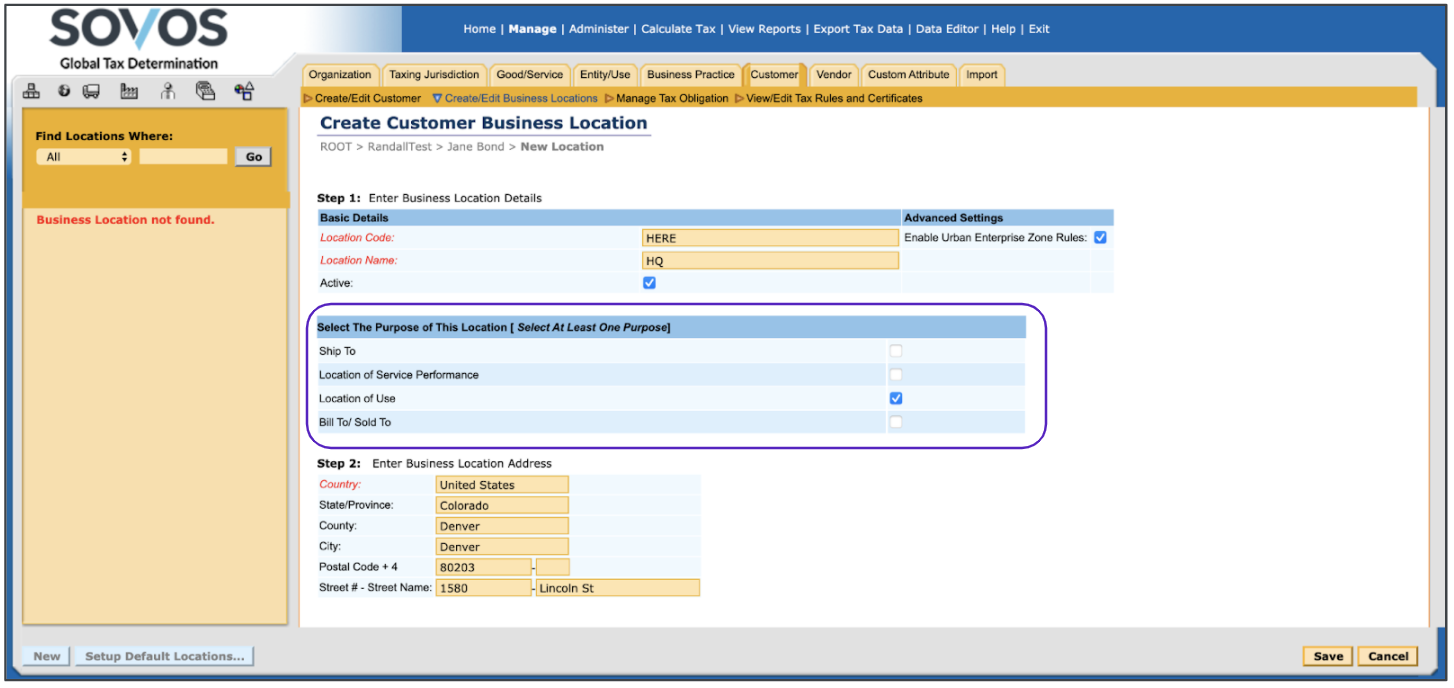

Check one or more of the following checkboxes to specify the purpose of the business location:

Ship To: The business location to which your organization ships goods.

Location of Service Performance: The business location where the service purchased by the customer is performed.

Location of Use: The business location where the goods or services provided by your organization are used by the customer.

Bill To/Sold To: The business location to which your organization sends invoices for goods or services sold to the customer.

-

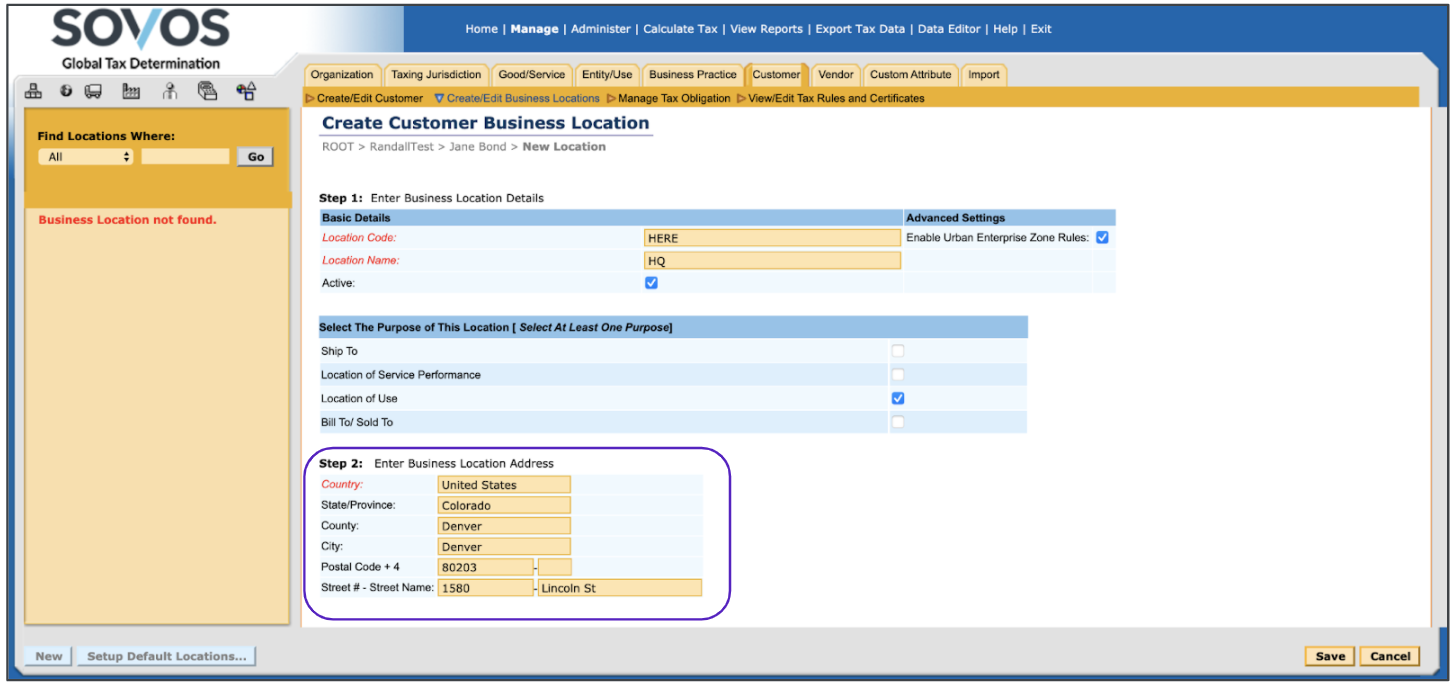

In Step 2, fill out the address information of the business location.

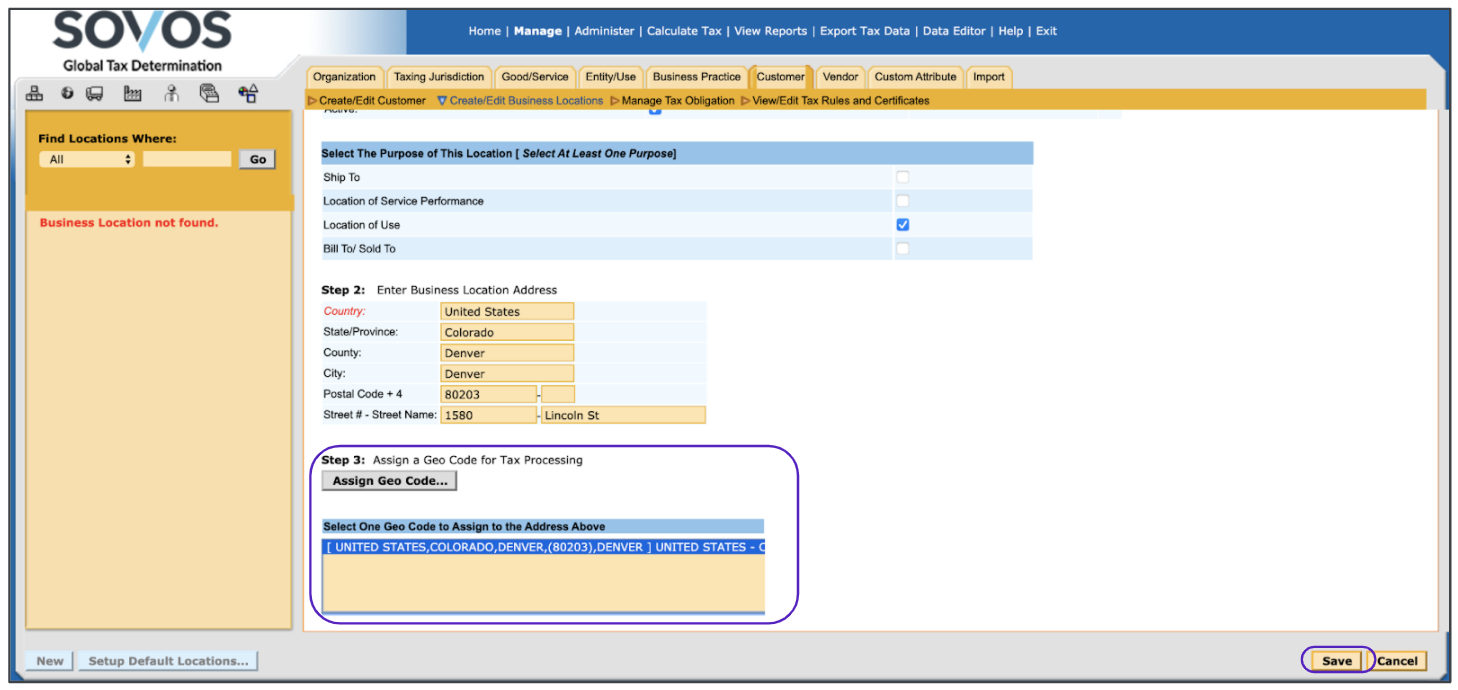

- In Step 3, click Assign Geo Code...

- Select the appropriate Geo Code from the list.

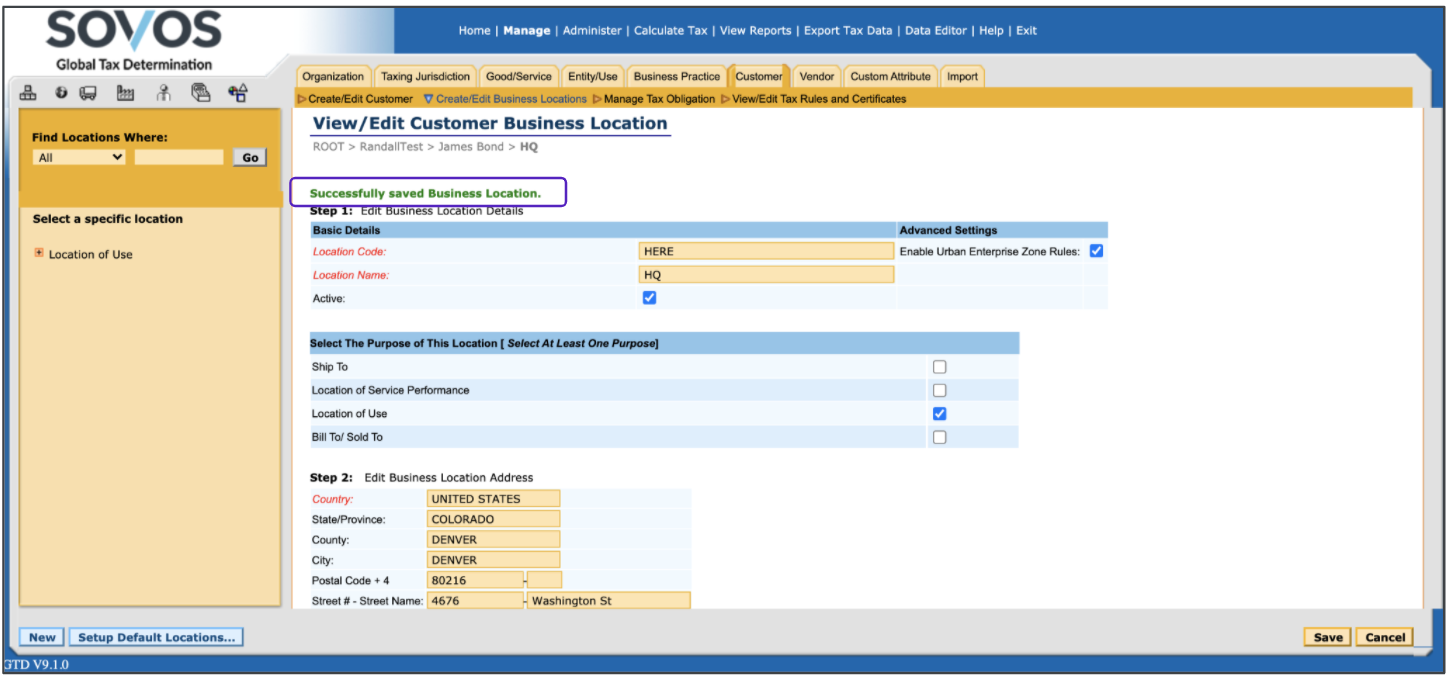

- Click Save.

-

When the new location is saved, you’ll see the following screen: