Whether or not a customer has a tax registration number can affect how Global Tax Determination calculates taxes on some international transactions. To add a tax registration number to a customer’s account, follow these steps:

- Log in to Global Tax Determination.

- Click Manage.

- Select your organization.

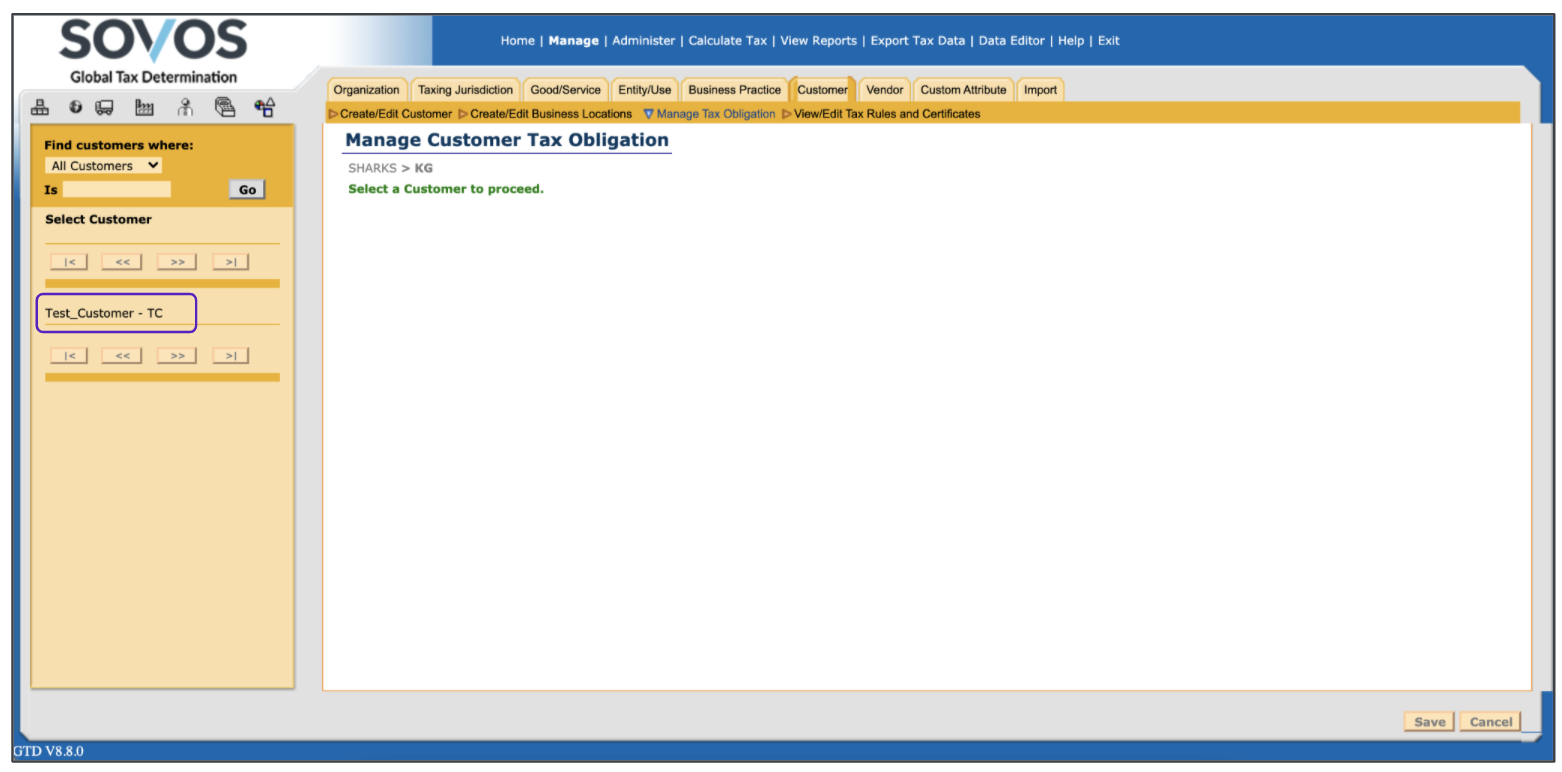

- Select the Customer tab then click the Manage Tax Obligation.

-

Select a customer.

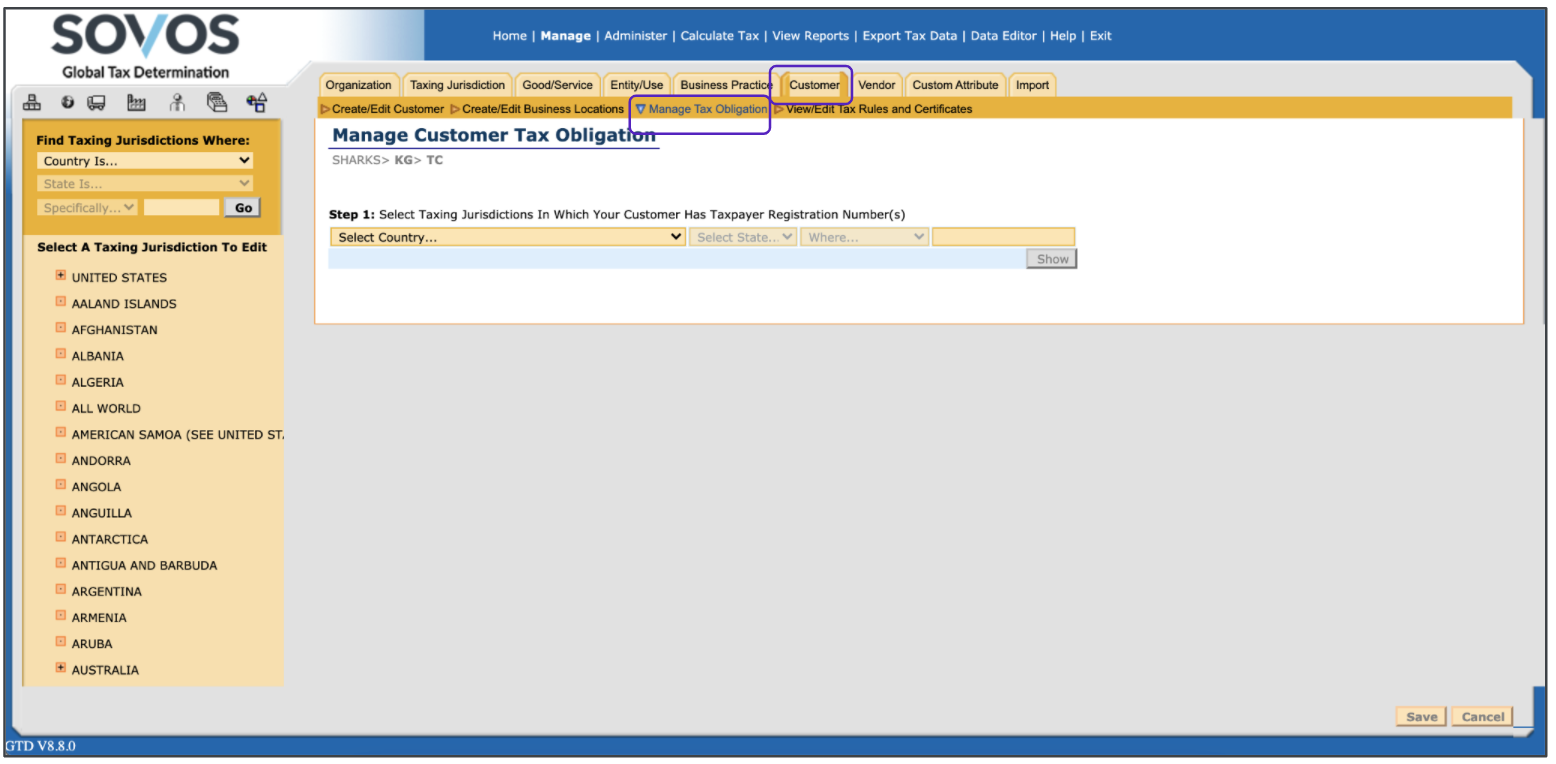

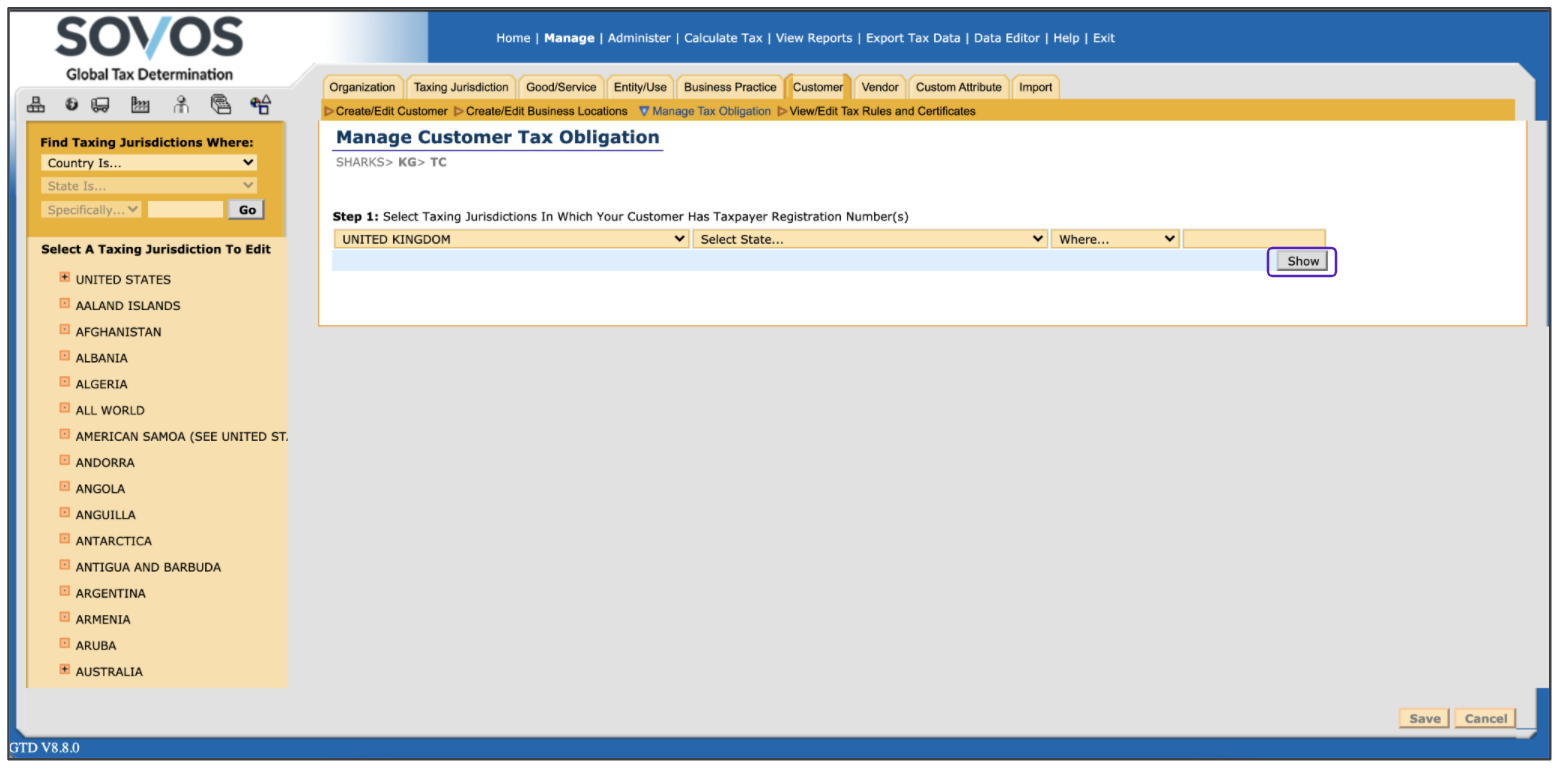

- In Step 1, select the taxing jurisdiction where your customer has a registration number.

- Click Show.

-

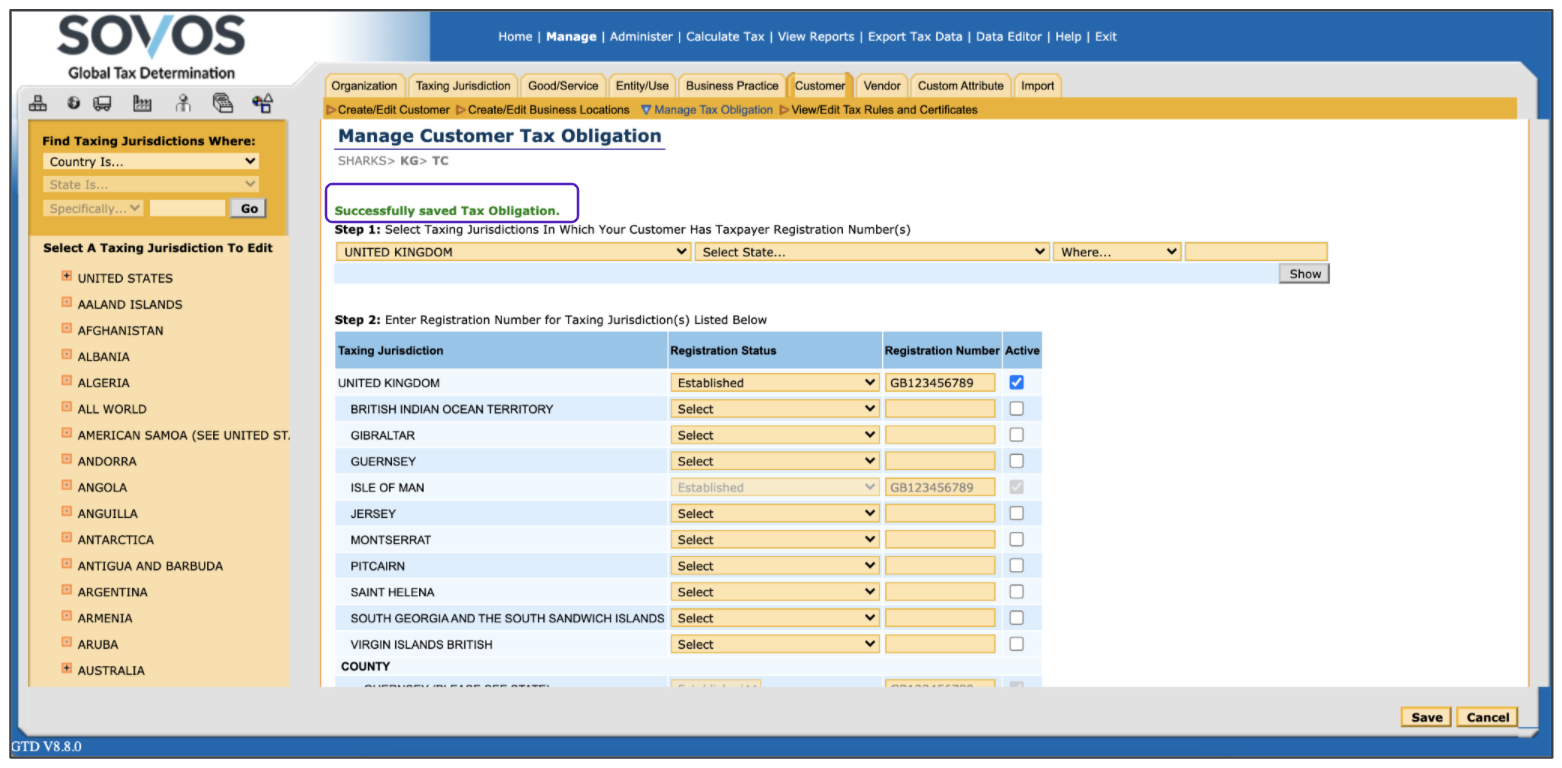

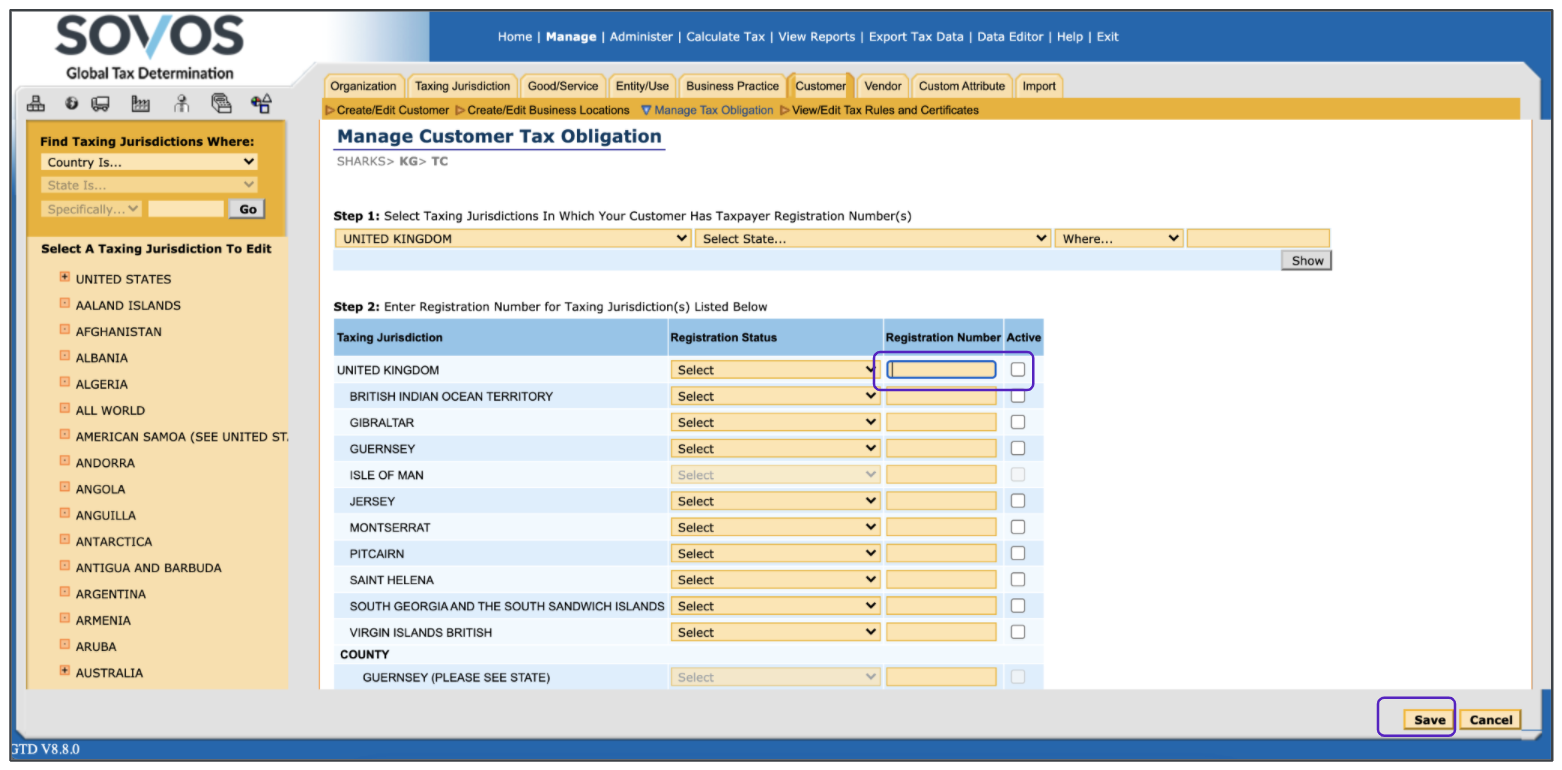

In Step 2, enter the registration status and registration number in the appropriate fields. The Active box will be automatically selected when the registration number is entered.

Country registration numbers must start with the country ISO code, for example, US for the United States, CA for Canada, GB for the United Kingdom. Entering a registration number is not required for customers located in the US.

- Click Save.

-

You’ll see the following success screen: