Nexus means that you have an obligation to collect and remit taxes in a given taxing jurisdiction.

A tax agency can be any vendor set up in NetSuite SuiteTax and can be used to funnel tax amounts to specific bank accounts in NetSuite SuiteTax. Every nexus should have its own distinct tax agency.

NetSuite SuiteTax supports nexus on the state level but not on the county, city, and district levels.

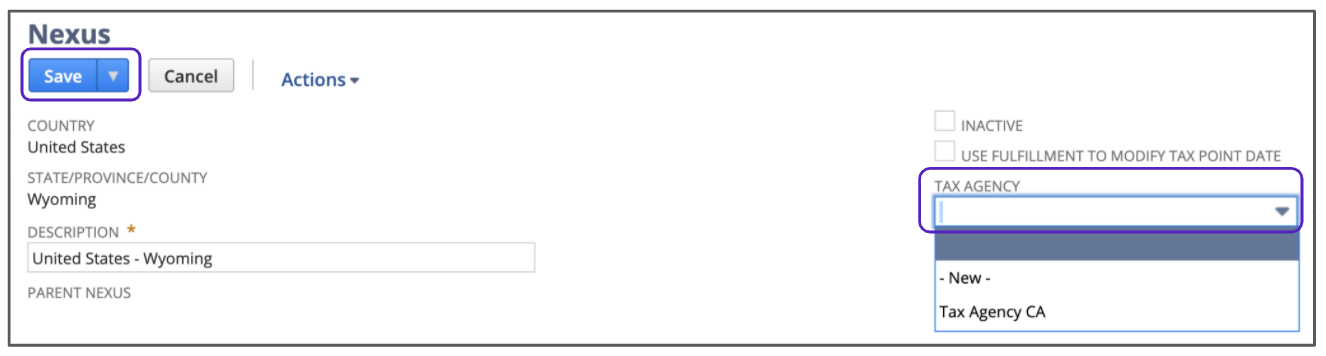

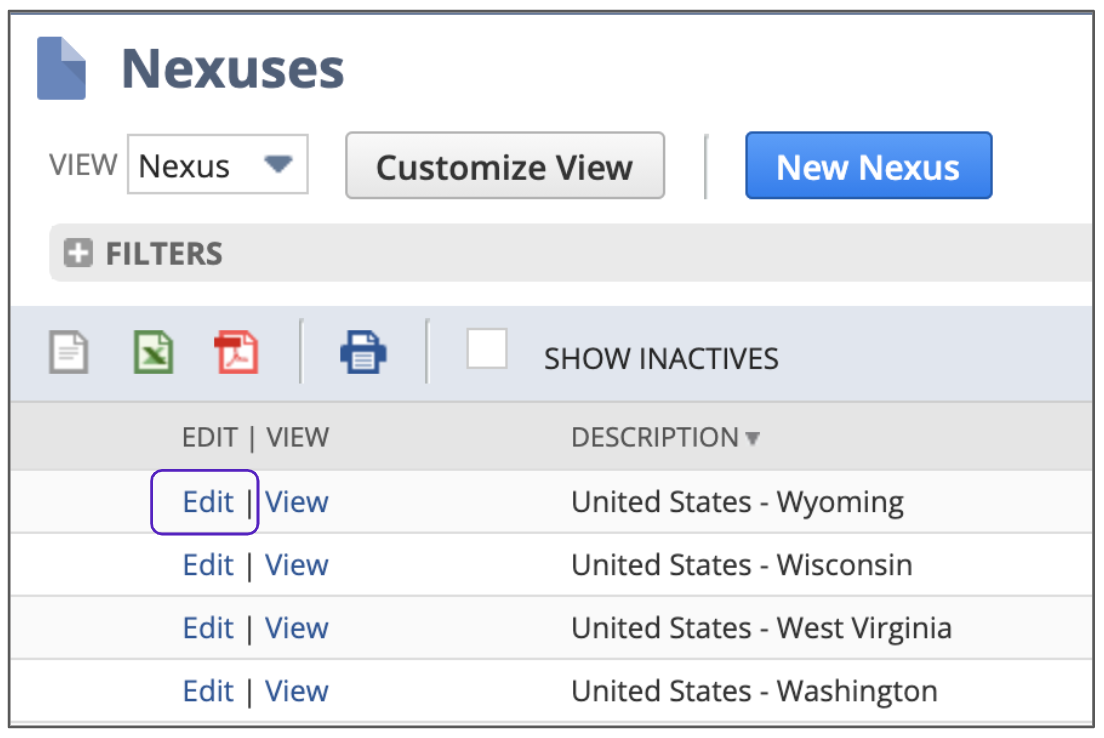

To add a tax agency to a nexus, follow these steps:

- Go to Setup > Tax > Nexuses.

- Select any nexus.

- Click Edit.

- Select a tax agency from the dropdown menu.

- Click Save.