To create an AP memo, make a non-PO-based invoice with supplier-charged tax first. See How to create a non-PO-based invoice with supplier-charged tax for instructions.

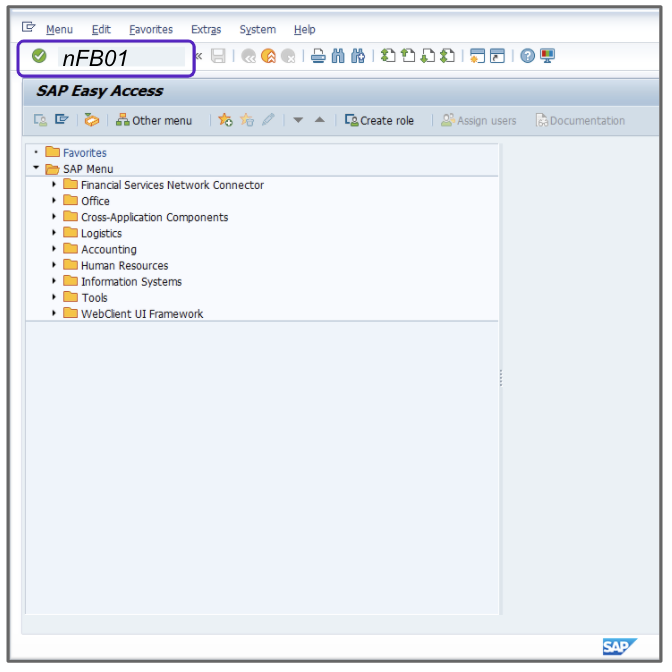

- Enter the T-Code /nFB01 to create an invoice.

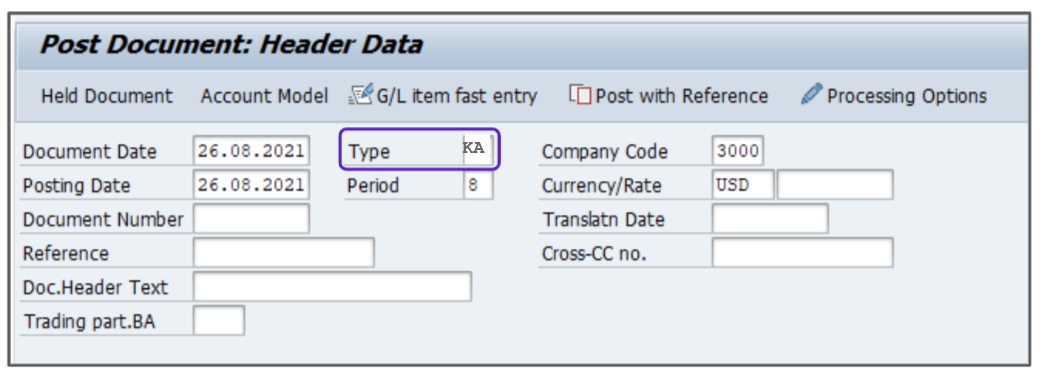

- Enter the current date in the Document Date.

- Enter KA in the Type field.

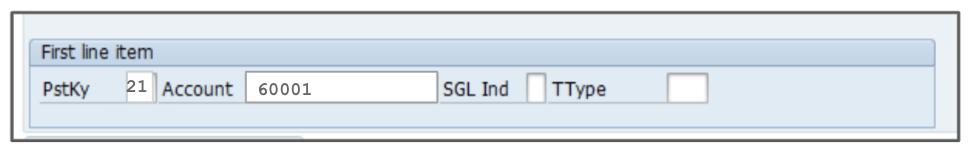

- In the First Line Item section, do the following:

-

- Enter the appropriate value, for example, 21 in the PKey field.

- Enter the appropriate value, for example, 60001 in the Account field.

This field should match the G/L Account field in the non-PO-based invoice with supplier-charged tax you had previously created.

-

- Press Enter. Ignore any warnings.

- Fill in the Amount field with the amount from the non-PO-based invoice with supplier-charged tax you had previously created.

- Verify that the Calculate Tax checkbox is NOT selected.

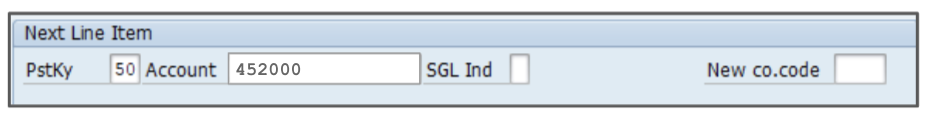

- In the Next Line Item section below, do the following:

-

- Enter the appropriate value, for example, 50 in the PKey field.

- Enter the appropriate value, for example, 452000 in the Account field.

This field should match the G/L Account field in the non-PO-based invoice with supplier charged tax you had previously created.

-

- Enter the Total amount excluding tax of the non-PO-based invoice with supplier-charged tax you had previously created.

- Select I1 Tax from the tax type dropdown menu.

- Enter the Tax Jurisdiction Code from the non-PO-based invoice with supplier-charged tax you had previously created.

- Enter the appropriate value in the Cost Center column, for example, 328.

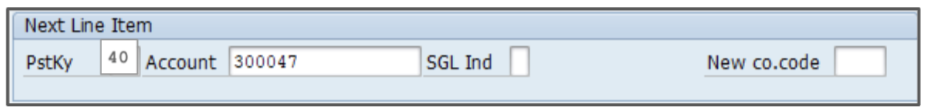

- In the Next Line Item section, do the following:

- Enter the appropriate value, for example, 40 in the PKey field.

- Enter a G/L Account in the Account field.

This field should match the G/L Account field in the non-PO-based invoice with supplier charged tax you had previously created

- Press Enter. Ignore any warnings.

- Enter the Total amount excluding tax from the non-PO-based invoice with supplier-charged tax you had previously created.

- Select I0 Tax from the Tax type dropdown menu.

- Enter the Tax Jurisdiction Code.

- Enter the appropriate value in the Cost Center field, for example, 328.

- Click Save to post the invoice.

- A new document number will be displayed at the bottom of your screen. Save this document number for your records.