This method is recommended if you want to update a few jurisdiction codes only. If you want to update a lot of codes, you can do a mass GeoCode update by running the GTD GeoCode Batch Program. See the Mass update of tax jurisdiction codes article for the details.

If you want to learn more about Geo Codes and taxing jurisdiction codes, read this article.

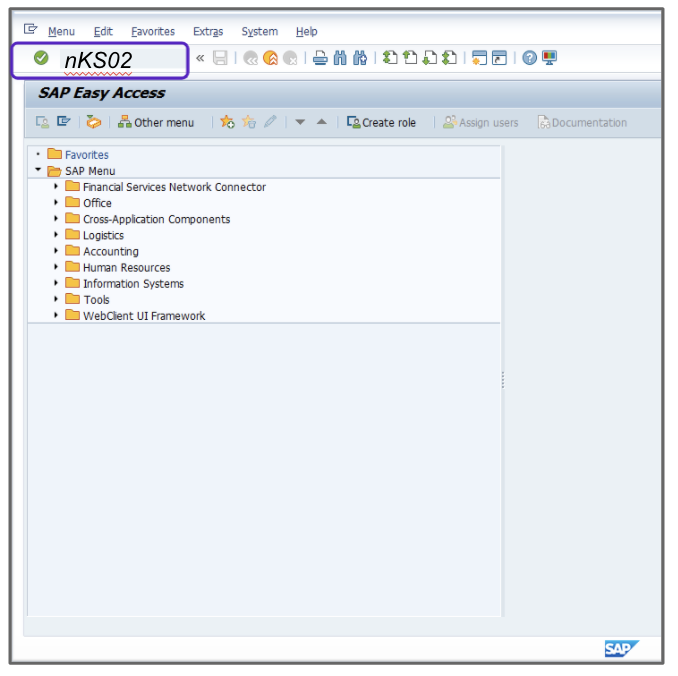

- Enter the T-Code /nKS02 to change and/or view the cost center.

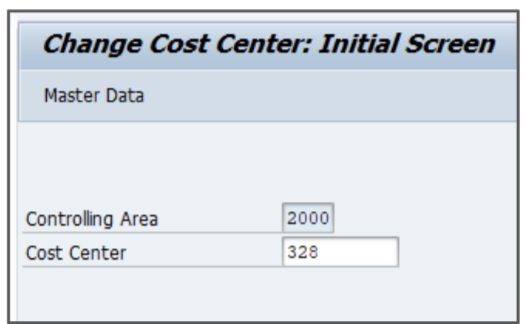

- Enter the appropriate Controlling Area when prompted.

- Enter a valid cost center in the Cost Center field.

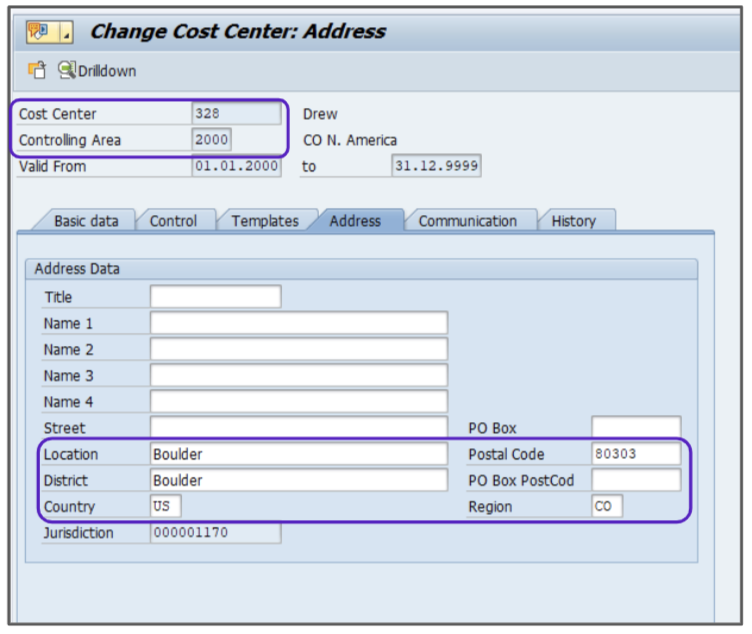

- Click the Address tab.

- Enter the appropriate value in the Postal Code field, for example, 80303.

- Enter the city in the City field, for example, Boulder.

- Change the Region field to the appropriate state, for example, CO.

- Press Enter.

Pressing Enter will initiate a RFC_DETERMINE_JURISDICTION call to the Adapter and Global Tax Determination.

- New tax jurisdiction codes will be returned. Select one by double-clicking it.

Talk to your tax consultant to see which jurisdiction code you should select.

- Click the

icon to continue.

icon to continue. - Click Save to save the cost center address with the new tax jurisdiction codes.