- Log in to Global Tax Determination.

- Click Manage.

- Select your organization by following the steps in this article.

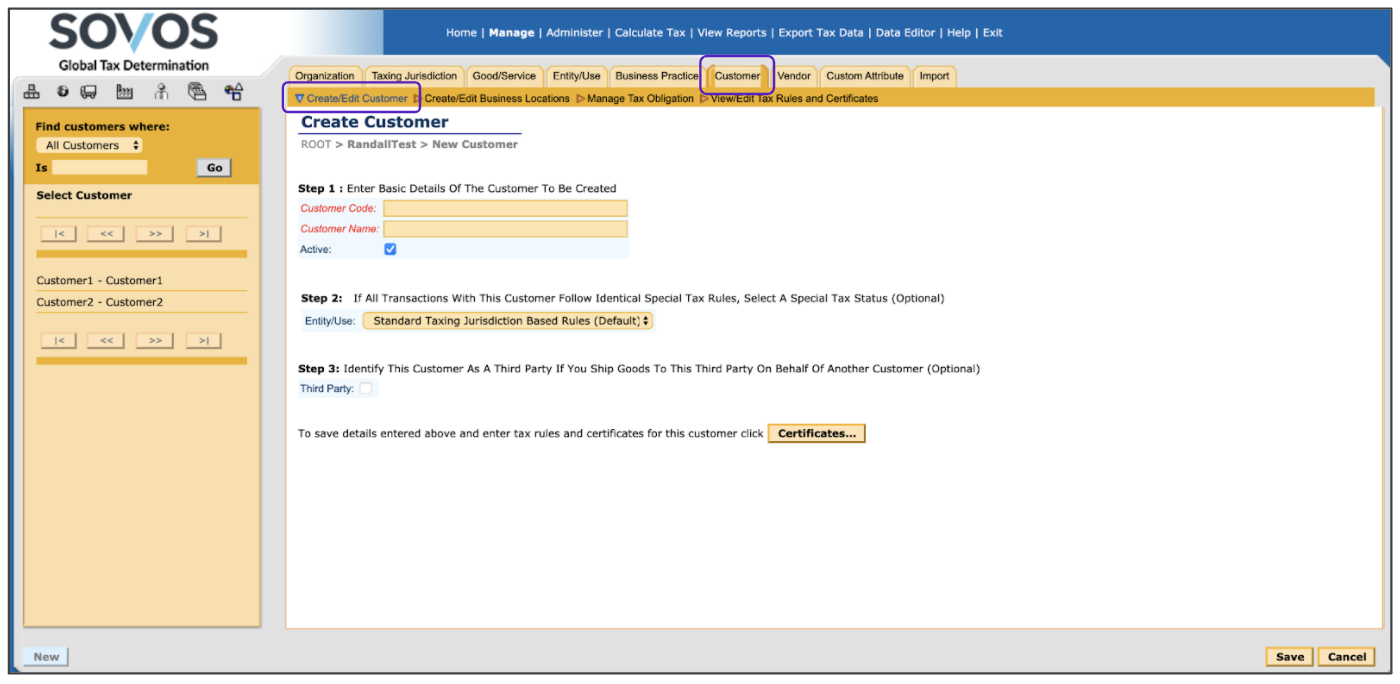

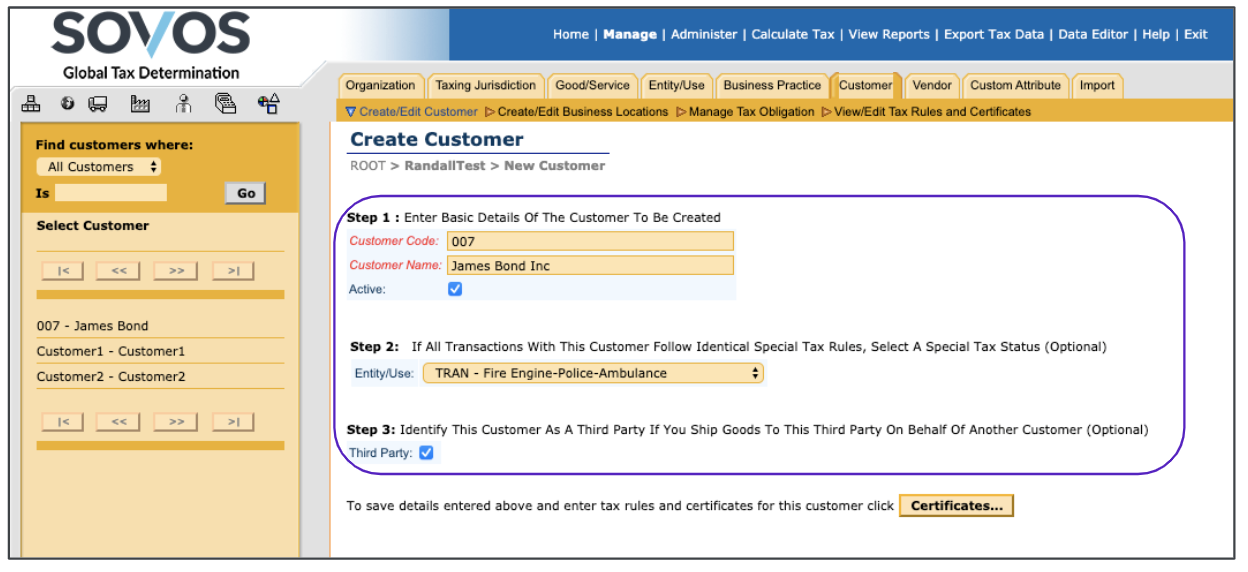

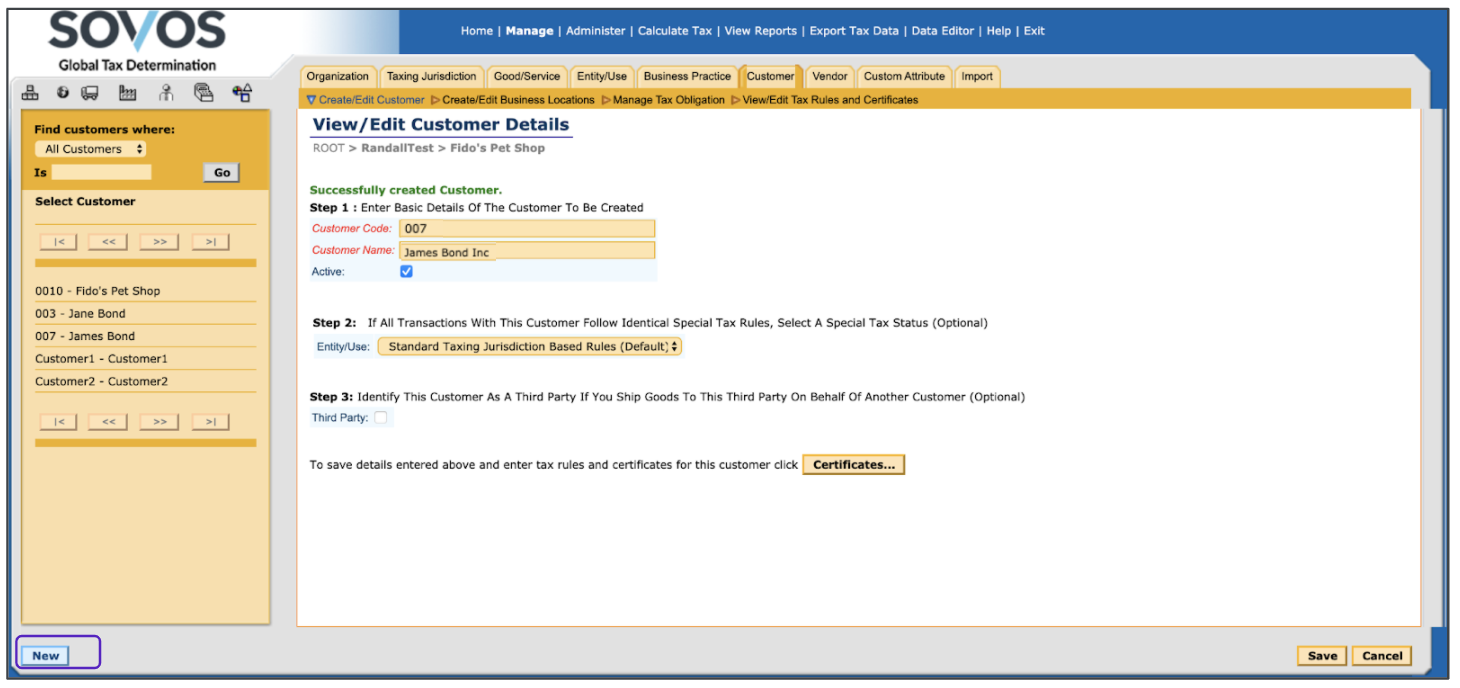

- Click the Customer tab, then select the Create/Edit Customer task.

- In Step 1, enter the Customer Code and Customer Name. These two entries will help Global Tax Determination to identify your customer.

Customer Code and Customer name don’t have to be the same. Customer Code can’t contain spaces and it must be unique within an organization. Customer Name can contain spaces and doesn’t have to be unique.

- Check the Active checkbox if you are currently doing business with this customer. If the customer is inactive, leave this box unchecked.

- In Step 2, select the Entity/Use code that applies to this customer. Read more about Entity/Use codes in this article.

Selecting an Entity/Use code is only required if the customer can be exempt for that reason. Otherwise, this field should be left blank.

- In Step 3, click the Third Party checkbox if you are a dropshipper and your customer is receiving goods from you on behalf of a third party.

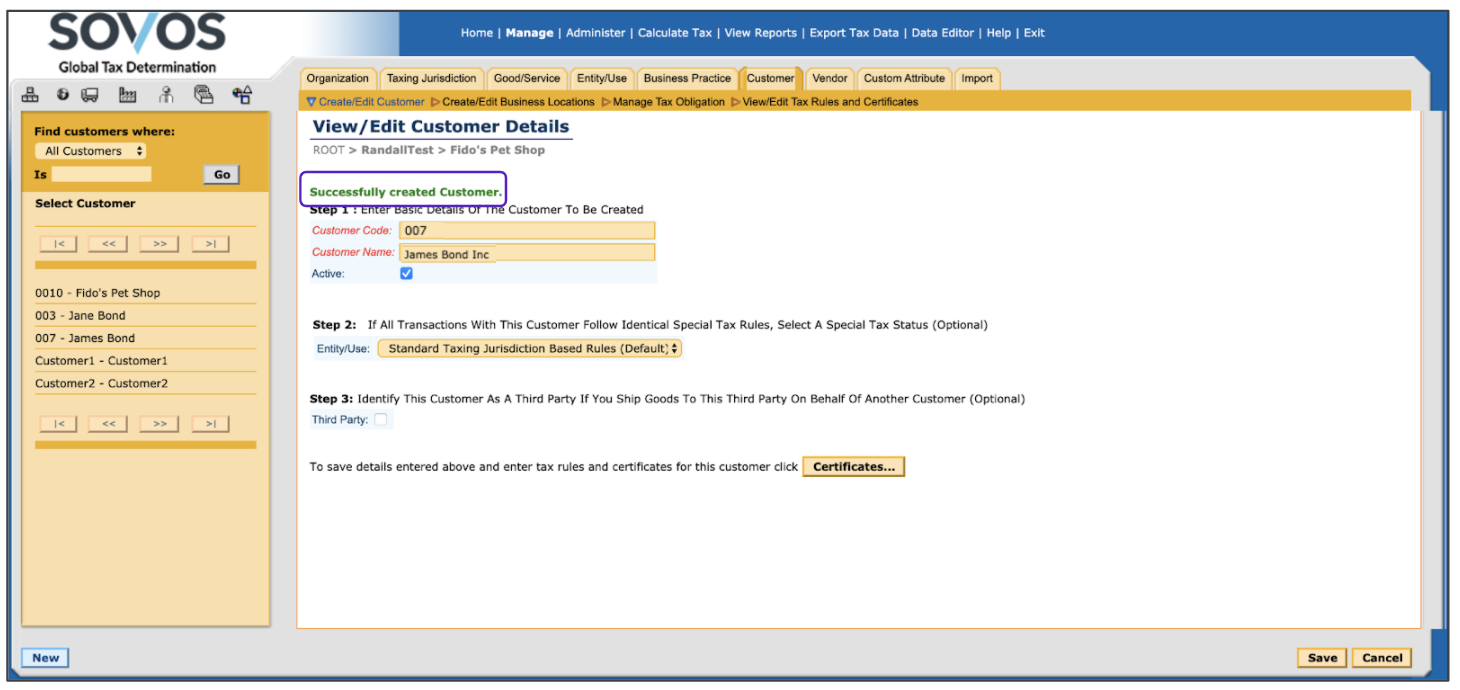

- Click Save.

- Once the customer data have been saved, you’ll see the following screen:

- You can now continue to add an exemption certificate, create the business location of the customer, add a tax registration number or create another customer by clicking New.

Customers can’t be deleted from Global Tax Determination for historical reference purposes, but a customer can be made inactive. An inactive customer is invisible to the software and will be treated as if it didn’t exist.